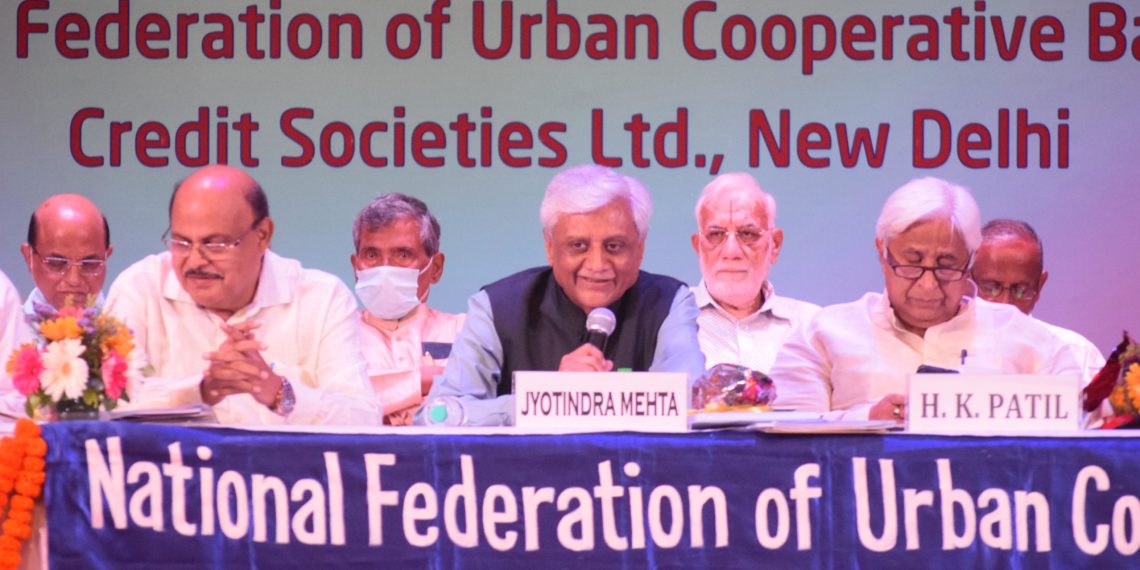

Taking a dim view of the introduction of the Banking Regulation (Amendment) Bill, 2020 and its provisions of Section 10 of the Act being made applicable to all the cooperative banks, Nafcub President Jyotindra Mehta has addressed a letter to the RBI governor urging him to revisit the whole thing.

Mehta argues the Act and its provisions are neither in conformity with cooperative laws nor with the provisions of the 97th Amendment of the constitution of India. Mehta’s letter reads “We submit that with the introduction of the Banking Regulation (Amendment) Bill, 2020 (Bill No. 56 of 2020), various provisions of Section 10 of the Act ibid have now been made applicable to all the cooperative banks.”

Mehta says as per Section 10 (2A) (i) of the Banking Regulation Act,1949, as amended in September 2020, “No director of the banking company, other than its chairman or whole-time director by whatever name called, shall hold office continuously for a period exceeding eight years.

“Needless to mention that the above provisions are neither in conformity with cooperative laws nor as per the provisions of the 97th Amendment of the Constitution of India Constitution)”, argues Mehta.

Mehta reminds that in terms of Section 243ZJ (2) of the 97th amendment of the Constitution, the terms of the office of elected members of the Board and its office bearers shall be five years from the date of the election, and the term of office bearers shall be co-terminus with the term of the Board. “There is also no provision restricting the re-election of members on the Board of the cooperative society”, he added.

Discussing various implications of the introduced Act in detail, the Nafcub President closes his letter calling upon the RBI to consider constituting a committee comprising members from RBI, Ministry of Cooperation, Govt. of India, a few state govts, NAFCUB and state federations to arrive at the modalities of implementation of the above amendments in a manner that the cooperative values of the UCBs are not affected while RBI has effective regulation.

Dear sir your time ingle suggestions on BRAct is highly appreciated