In a major development, Maharashtra government led by Eknath Shinde has given its nod for providing insurance cover upto Rs 1 lakh to the depositors of credit cooperatives of the state.

The decision is expected to be helpful for three crore depositors connected with more than 12,000 credit cooperatives of Maharashtra.

The state government has established a regulatory authority under the Chairmanship of Anil Kawade and infused a capital of Rs 100 crore in the initial stage.

The credit societies of Maharashtra have to pay 10 paisa for Rs 100 deposits as a premium and it will come into effect from 1st April 2024. Reacting to this development one of the cooperators said, “There will be a cooling period of three years, which means if any of the credit societies fails in the span of three years the authority is not responsible. It is accountable only after three years”.

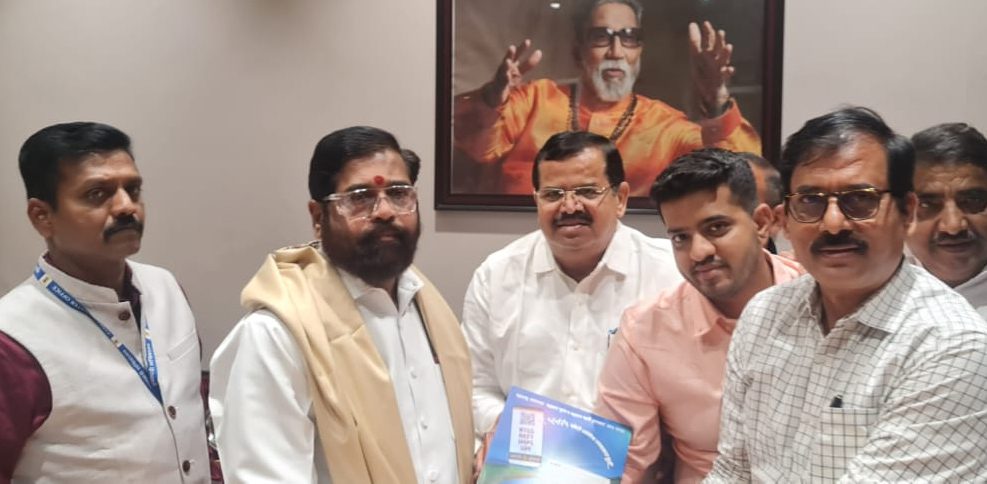

Thanking one and all from Eknath Shinde to Devendra Fadnavis, Ajit Pawar to Dilip Walse Patil, Jijaba Pawar, the Chairman of the largest credit co-operative of Maharashtra-Dnyandeep Credit Cooperative Society said, “We welcomed the move of the state government in taking this decision in the interest of depositors, he noted.

“This will not only help depositors of credit cooperatives but also have an impact on investors who put their hard earned money in cooperatives on trust”, he added.

Pawar further said, “The depositors of all credit institutions in the state will get protection up to Rs 1 lakh. In the initial stage, the government has infused a capital of Rs 100 crore which is fully refundable. Our society has made a provision of Rs 3.10 crore for making contributions towards the insurance cover of depositors”.he said.

Giving his reaction, Sahakar Bharati National General Secretary Uday Joshi said, “Despite creating an internal body under the chairmanship of Anil Kwade, there should be a separate independent corporation on the lines of DICGC to protect the interest of depositors of credit cooperatives”, he suggested.

“The funds infused by the state government is refundable and it is to be refunded in a year. There is a need to infuse paid up capital of Rs 300 crore for making the move concrete”, he added.

Earlier, the state government amended the Maharashtra State Cooperative Act and added a new chapter with a title ‘Stabilization and Liquidity Assistance Fund’ for providing insurance coverage to the depositors of credit cooperatives but there had been no further development in this connection. Now, it has become active and the government has infused Rs 100 crore under this fund.

It bears recalling that for the last several years, representatives of credit cooperatives have been urging the state as well as the central government to form a body for providing insurance cover to depositors on the lines of DICGC. This move is bound to help depositors of credit cooperatives.