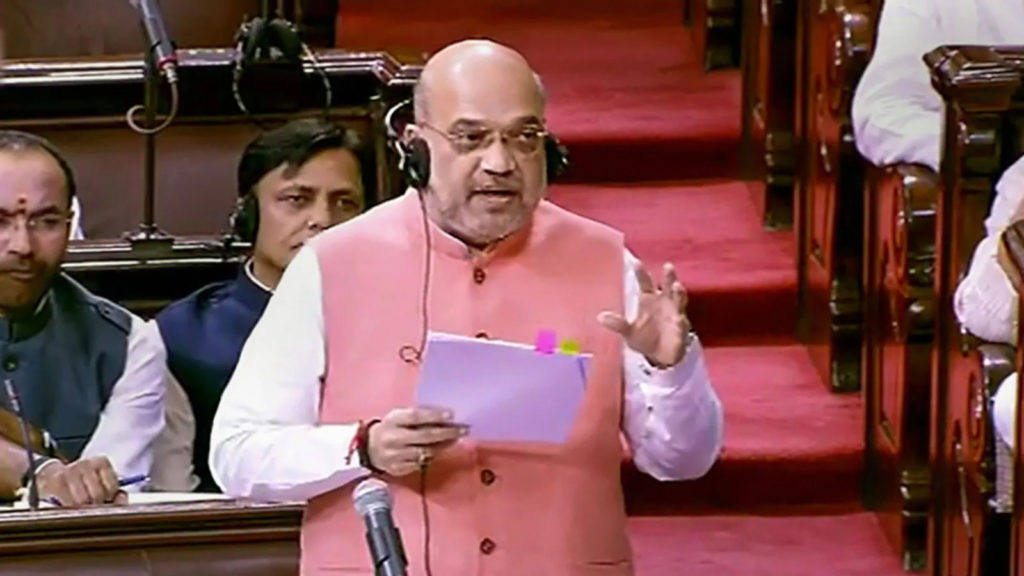

A comprehensive effort to digitize cooperative banks is underway, said Shri Amit Shah, in a written reply to a question in the Lok Sabha. He touched upon UCBs, Umbrella Organization, ARDBs, DCCBs, StCBs and PACS.

Shah said in a significant push towards modernization, the Reserve Bank of India (RBI) has mandated all cooperative banks to adopt the Core Banking Solution (CBS). This initiative aims to streamline operations and enhance the efficiency of these financial institutions.

For Urban Cooperative Banks (UCBs), the RBI has approved the formation of a national-level Umbrella Organization, named the National Urban Co-operative Finance and Development Corporation (NUCFDC), he added,

This organization is set to bolster UCBs’ operational efficiency and provide them with cutting-edge IT solutions. On February 8, 2024, NUCFDC received its Certificate of Registration (CoR) from the RBI, allowing it to function as a Non-Banking Financial Institution (NBFI), he stated.

NUCFDC’s mission is to accelerate the digitization of UCBs by leveraging collective strengths, conducting technological reviews, fostering collaboration, promoting innovation, and preparing member banks to adeptly navigate the complexities of the digital era, he added.

To operate as a self-regulatory organization under the RBI, NUCFDC aims to reach a paid-up capital of ?300 crore, with the National Cooperative Development Corporation (NCDC) committing to contribute 20% of this amount, said Shah.

Similarly, the National Bank for Agriculture and Rural Development (NABARD), which oversees Rural Cooperative Banks (RCBs), is actively working to enhance their IT infrastructure. In collaboration with the Ministry of Cooperation and the RBI, NABARD has proposed the formation of a Shared Services Entity (SSE) to provide digital services to RCBs, ensuring they are equipped for digital transformation, he underlined.

In addition, the Government of India has sanctioned a project for the computerization of functional Primary Agricultural Credit Societies (PACS) with a total financial outlay of Rs 2,516 crore, he said.

This project aims to bring all functional PACS across the country onto a unified ERP-based national software, integrating them with NABARD through State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs). Approximately ?794 crore has already been disbursed for the project, he stated.

Further, the government has approved the computerization of Agriculture and Rural Development Banks (ARDBs) across 13 States and Union Territories, to strengthen the long-term cooperative credit structure. In the fiscal years 2023-24 and 2024-25, the Government of India’s share of Rs 4.26 crore was released to eight states and UTs for the procurement of hardware, digitization efforts, and the establishment of support systems, he summed up.