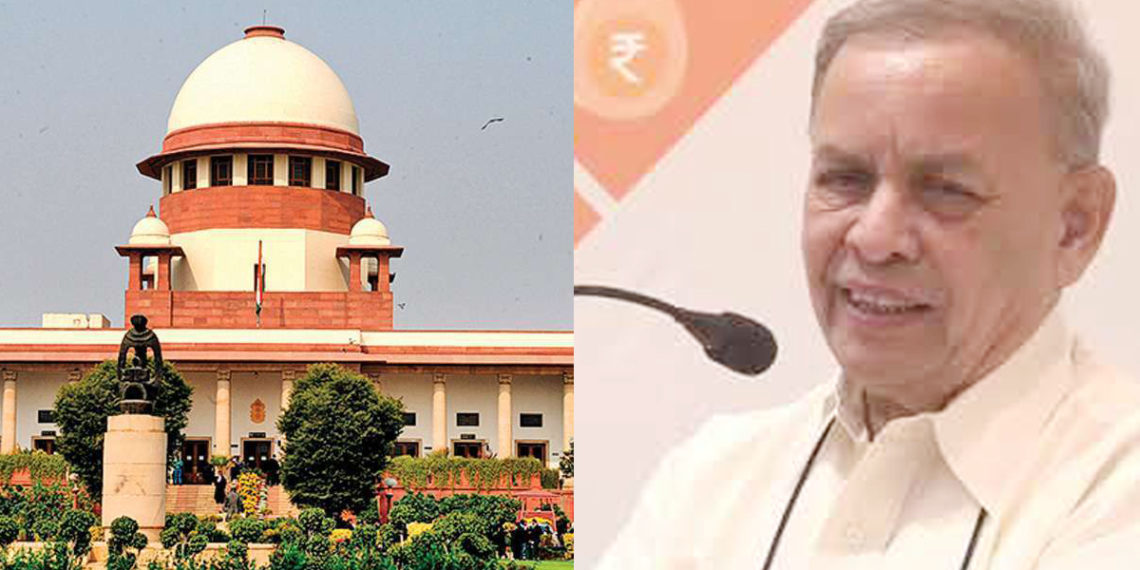

Senior co-operator Satish Marathe has hailed the judgement of the Supreme Court, in which it allowed the banks and financial institutions to initiate insolvency proceedings against personal guarantors, usually promoters and the top brass of debt-laden companies.

Reacting to the news, RBI Board member and senior Sahakar Bharati leader Satish Marathe said the judgment would go a long way in helping banks in resolving the issue of bad debts.

Writing on his FB wall Marathe said “Thank you Supreme Court”. He said the judgement will have far-reaching consequences not only on the banks but also on the health of the overall Indian economy.

It bears recall that the government has in November, 2019, issued notification allowing banks and financial institutions to move against personal guarantors of companies facing insolvency. Now the apex court has upheld the same allowing banks and others to proceed not only against the corporate debtors but also against their personal guarantors in case of bad loans.

Experts say that IBC Code formulated by the Modi govt was partially a non-starter for want of the provision accorded to the banks through the govt’s 2019 notification.

Marathe said the judgment gives the much-needed teeth to lenders and will expedite the process of recovery of bad debts. The judgement is directly going to affect the likes of Anil Ambani of Reliance Power, Venugopal Dhoot of Videocon, Atul Punj , among others.

It bears recall that the Insolvency and Bankruptcy Code which was promulgated in 2016, is the bankruptcy law which seeks to consolidate the existing framework by creating a single law for insolvency and bankruptcy.

The Insolvency and Bankruptcy Code, 2015 was introduced in Lok Sabha in December 2015. It was passed by Lok Sabha on 5 May 2016 and by Rajya Sabha on 11 May 2016. The Code received the assent of the President of India on 28 May 2016.

The bankruptcy code is a one stop solution for resolving insolvencies which previously was a long process that did not offer an economically viable arrangement. The code aims to protect the interests of small investors and make the process of doing business less cumbersome.