The National Consultation with Rural Cooperative Banks held in Mumbai on December 29, 2023, marked a significant moment in the realm of cooperative banking. The event was organized by the National Federation of State Cooperative Banks (NAFSCOB).

The event saw the presence of heavyweights like Dileep Sanghani, President of the National Cooperative Union of India; Karnataka Cooperation Minister K N Rajanna; Dr. Chandra Pal Singh Yadav, President of ICA-AP; Dr. Bijender Singh, Chairman of NAFED; Satish Marathe, Director, Central Board, RBI es; G S Rawat, DMD, NABARD; Ravindra Rao, Chairman, NAFSCOB; and Bhima Subramaniyam, MD, NAFSCOB.

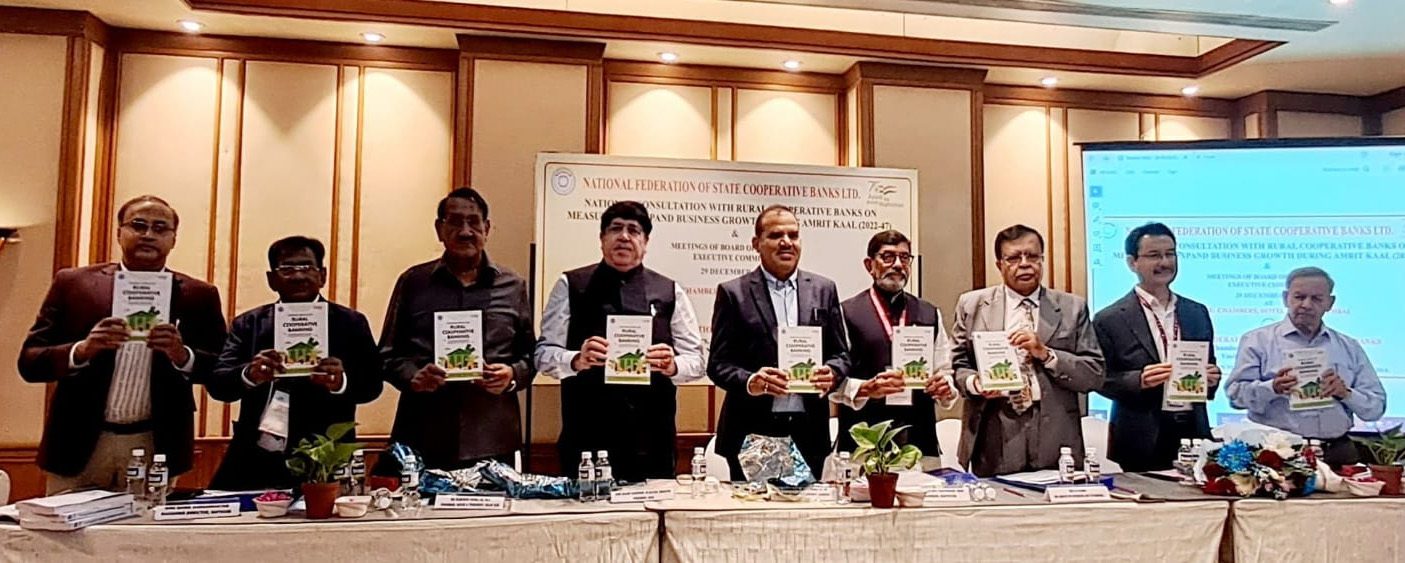

The focal point of this gathering was the unveiling of an innovative training module for Rural Cooperative Banking, specifically designed to foster inclusive finance through business diversification. Shri Dileep Sanghani, in his address, emphasized the paramount importance of this training module in enhancing the capabilities of rural cooperative banks. He shed light on various training modules released by the National Cooperative Resource Centre (NCRC) of NCUI, reinforcing the commitment to equipping cooperative banks with the necessary knowledge and tools for sustainable growth.

The Rural Cooperative Banking Training Module unveiled at the event is a response to the evolving dynamics of rural landscapes during the transformative period of Amrit Kaal (2022-2047). It aims to equip cooperative banks with a comprehensive understanding of operational complexities, compliance standards, and key aspects of business diversification and effective marketing strategies. This, in turn, will empower them to play a more influential role in financial inclusion and education for marginalized communities.

Sanghani highlighted the release of two general training modules and two sector-specific modules, emphasizing the commitment to broadening the knowledge base of cooperative members. The modules cover critical areas such as the role of members in cooperatives, governance, business development, and diversification in primary agricultural credit societies, and the promotion of durable, affordable housing.

In his closing remarks, Sanghani underscored the importance of rural cooperative banks in promoting financial inclusion and economic growth in rural areas. He emphasized the need for adaptation and innovation in response to the changing needs of rural communities and called for a renewed commitment to the development of rural cooperative banking in India.

The event not only served as a platform for unveiling a cutting-edge training module but also as a catalyst for raising awareness and fostering education in the cooperative banking sector. The dedication and commitment of NAFSCOB and the cooperative banking sector were acknowledged, paving the way for a brighter future for rural cooperative banking in India. Sanghani concluded his remarks with – “Jai Hind, Jai Sahakar,” echoing the sentiment of collective progress and prosperity through cooperative endeavours.