Sahakar Bharati has presented its view before the Expert Committee formed by the RBI to take stock of the existing regulatory measures in respect of UCBs and assess their impact over the last five years has submitted its Report. The Committee was also entrusted with the task of identifying key constraints and enablers, if any, in fulfilment of their socio-economic objective.

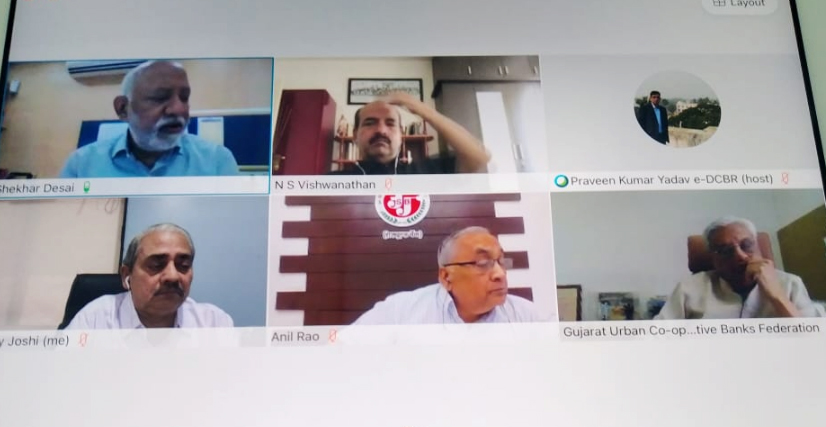

In a virtual session lasting more than two hours Sahakar Bharati team presented their recommendations. All the EC members barring Harsh Kumar Bhantwala, former Chairman, NABARD and Prof M. S. Sriram, IIM Bangalore were present in the meeting.

The Sahakar Bharati team working on the project included Dr Uday Joshi, National General Secretary, CA Anil Rao, Chairman, Jalgaon Janata Sah Bank Ltd and CA Shekhar Desai, CEO, Thane Bharat Sah Bank Ltd.

While N. S. Vishwanathan, former Deputy Governor, RBI is its Chairman, Jyotindra M. Mehta, President, NAFCUB is one of the members of the EC, among others. The deadline for EC to submit its final recommendations after collecting inputs from the stakeholders was extended till June 30.

Among other things, the Sahakar Bharati Report asks for revamping the present TAFCUB arrangement as it has become dysfunctional. Welcoming RBI move on Umbrella Organisation for the UCB Sector, the Committee felt RBI will need to infuse Capital and also extend handholding support by deputing its Officials, at least for the first 5 years.

The Standing Advisory Committee for UCBs also needs to be broad based and should meet at least twice a year say in late July (by which time post Audit and Finalisation of Accounts, Returns are received by RBI) and in early November when the exercise for Annual Budget commences in the Ministry of Finance.

The present practice to invite on rotation basis Representatives only of large UCBs and some Office Bearers of State Federations along with NAFCUB needs to be modified to include Representatives from different Tiers of UCBs, Co-operators and Bankers.

The committee in its Report has noted with a sense of satisfaction that about 84% UCBs had CRAR > 12%, 74.5% UCBs attend ratings A, B+ & B, A, B+ & B rated Banks accounted for 75.5% and 76% Deposits and Advances respectively.

It has also noted that D rated UCBs had only an aggregate Share of 3.8% of Deposits & Advances while Lending by UCB Sector to Priority Sector constituted about 50% of total Lending by UCBs as against 41% by PSBs, 40% by PvtSB.

“However, due to failure of PMC Bank and Guru Raghavendra Bank the GNPAs at 10.8%, NNPAs at 5.1% and Provision Coverage Ratio at 60.3% stood at reduced levels vis-à-vis the previous year. UCBs could have posted much better results, year after year, had RBI also focussed on Growth and Development of the Sector”, reads the Report.

The whole report can be accessed by clicking the link below