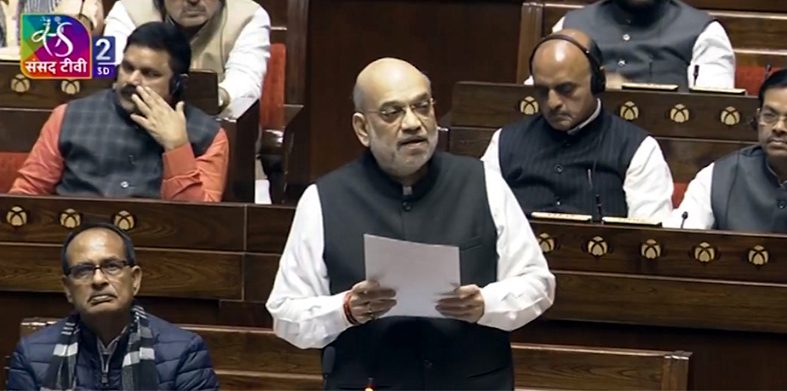

In a recent statement to the Rajya Sabha, Union Minister Amit Shah revealed that the Umbrella Organization (UO) for Urban Cooperative Banks (UCBs) has commenced its operations and begun rolling out essential services to address the pressing needs of UCBs.

He disclosed that the UO will offer Sahakar CBS, a standardized Core Banking Solution tailored for all UCBs, particularly Tier 1, Tier 2, and Unit Banks. Additionally, the UO is providing Legal Advisory Services, offering free templates and vetting for basic agreements required by banks.

While complex agreements are chargeable, their costs remain significantly below market rates. Another key service is the Sahakar Compliance Monitoring Service, which automates regulatory compliance by integrating banks’ Core Banking Systems (CBS) with the RBI’s Daksh portal. Furthermore, Technology Consulting Services are available, assisting banks with various aspects of CBS, cybersecurity, and IT compliance.

The UO has also issued an Expression of Interest (EOI) for the implementation of several initiatives. Among them is Sahakar Cloud, designed to create a cloud-based data center that will reduce costs by achieving economies of scale.

Another initiative, SahakarBox, offers an innovative solution ensuring that even small UCBs can access affordable cybersecurity, resiliency, disaster recovery, and backup services.

Additionally, the Sahakar Council – Expert Panel has been established to provide external expert advice in areas such as taxation, audit, treasury, compliance, and business development.

Minister explained that the establishment of the UO was essential to address the difficulties faced by UCBs, which have long operated in a fragmented and uncoordinated environment. Challenges such as a lack of regulatory clarity, operational inefficiencies, and limited access to resources have left many UCBs vulnerable to financial instability, weak governance, and market pressures.

To provide a sustainable solution, the National Urban Co-operative Finance and Development Corporation (NUCFDC) has been formed as the UO. Its objective is to enhance the financial resilience of UCBs, boost depositor confidence, and position them as key players in India’s financial system. The UO will offer both fund-based and non-fund-based services to UCBs.

Fund-based services include capital support, loans and advances, refinance facilities, and liquidity support against excess SLR securities through repo transactions. It will also accept deposits from UCBs.

Meanwhile, non-fund-based services cover IT infrastructure development for member banks, fund and treasury management services, consultancy in various operational areas, capacity-building programs such as training, seminars, and conferences, as well as research and development.

With these initiatives, the UO is set to transform India’s UCB sector, ensuring financial stability and long-term growth.