Deposit Insurance and Credit Guarantee Corporation (DICGC) settled insurance claims worth of Rs 10,503 crore of 363 cooperative banks upto 31st March 2023, out of which Rs 3,956 crore repayments received (1.5 crore- Written off). The net amount paid by the DICGC to the depositors of cooperative banks is Rs 6,545 crore.

It has been revealed in the DICGC Annual Report 2022-23 released recently.

The majority of insured banks are from Maharashtra i.e 508 cooperative banks, which includes 476 urban cooperative banks of the state.

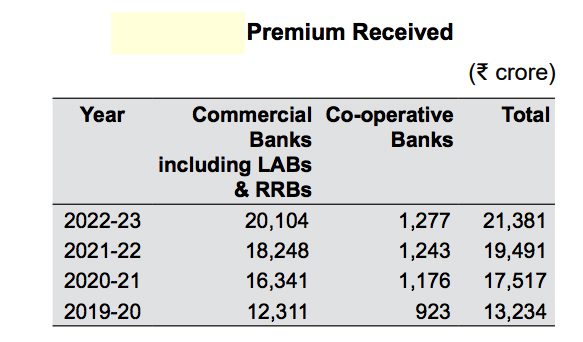

The total premium received by the Corporation during 2022-23 stood at Rs 21,381 crore, with commercial banks contributing 20,104 crore (94.03 percent) and cooperative banks accounting for the remaining 1,277 crore (5.97 percent).

Since the inception of deposit insurance, a cumulative amount of Rs 295.85 crore has been paid up to March 31, 2023 towards claims of 27 commercial banks, Rs 10,631.80 crore towards claims of 374 liquidated cooperative banks (including Rs 105.77 crore settled during the year) and Rs 4,103.45 crore towards claims of 36 cooperative banks placed under All Inclusive Direction.

In the case of cooperative banks, cumulative recoveries from the liquidators/ transferee banks aggregated to

The insurance premium (at the rate of Rs 0.12 per Rs 100 of assessable deposits) collected from insured banks by the Corporation during the year was Rs 21,381 Crore (i.e., Rs 213.81 billion) with 94.03 per cent of the amount from commercial banks and the remaining from cooperative banks.

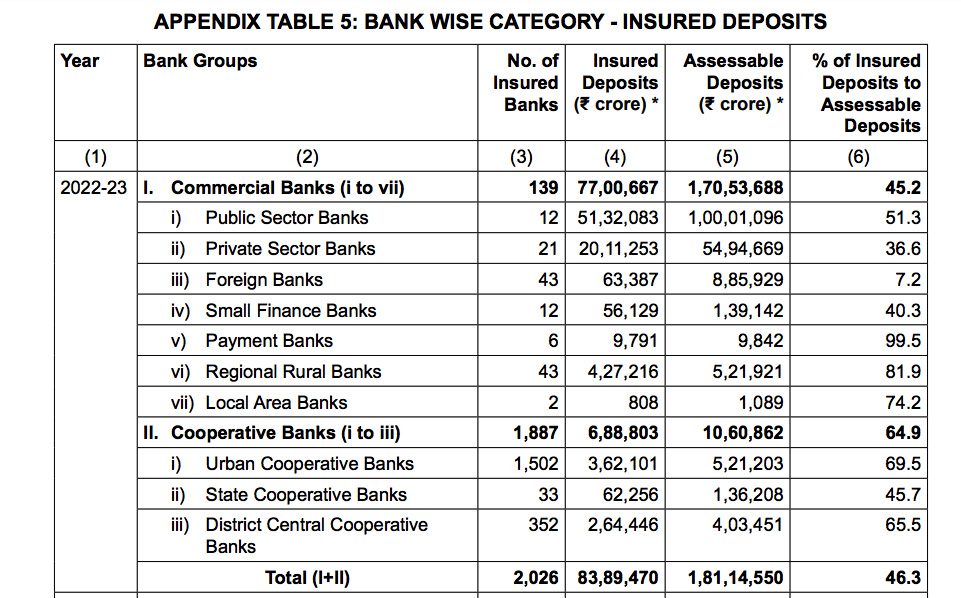

Readers would recall that the deposit insurance cover increased from Rs 1 lakh to Rs 5 lakh with effect from February 4, 2020.

Interestingly, the report has been silent on how much premium has been collected by the DICGC from cooperative banks since its inspection.