As reported in these columns earlier, the Reserve Bank of India convened a strategic conference in the Western Zone on Friday, engaging directors from select large Urban Cooperative Banks (UCBs).

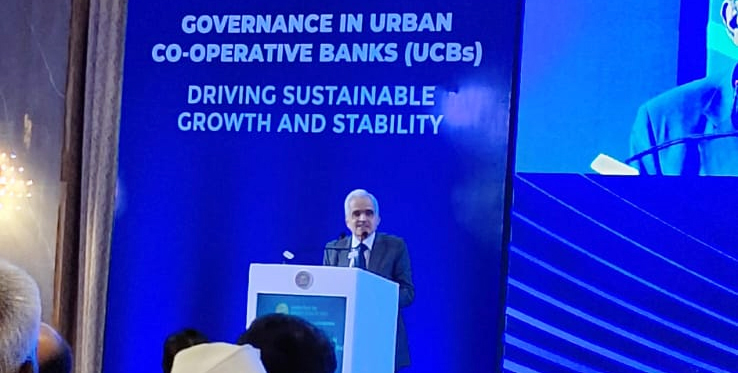

The RBI Governor inaugurated the event, themed ‘Governance in UCBs – Driving Sustainable Growth and Stability,’ underscoring the continued emphasis on robust management practices within the cooperative banking sector.

This gathering, held in the Western Zone, marks the latest in a series of conferences, following previous sessions in Mumbai, Hyderabad, and Lucknow conducted in August 2023, January 2024, and April 2024, respectively. The ongoing dialogue reflects the RBI’s proactive approach to fostering effective governance among UCBs.

Governor Shri Das, in his keynote address, stressed the critical role of the Board of Directors in ensuring strong governance frameworks. He highlighted the necessity of maintaining stringent compliance, risk management, and internal audit functions as essential pillars of governance.

Deputy Governor Shri Swaminathan delivered a special address focusing on the unique position of UCBs in bridging the gap for the unbanked population, advocating for the enhancement of their financial and operational resilience.

This, he noted, is crucial for the sustainability of systemic stability across the banking sector. He also encouraged the cooperative banks to engage fully with the newly established Umbrella Organisation, designed to support their developmental needs.

The conference featured a comprehensive agenda, with sessions dedicated to IT and cybersecurity, governance, assurance functions, and an overview of supervisory and regulatory expectations set by the RBI. These discussions aimed to align the operational strategies of UCBs with best practices in banking governance.

An interactive segment concluded the conference, where participants engaged directly with the RBI’s Executive Directors in an open house format. This allowed for an in-depth exchange of ideas and feedback, facilitating a mutual understanding of the challenges and opportunities lying ahead for the cooperative banking sector.

The RBI’s sustained effort through these conferences to enhance governance among UCBs reflects its commitment to ensuring a stable and growth-oriented cooperative banking framework, which is vital for the broader goal of financial inclusivity and economic stability in India.