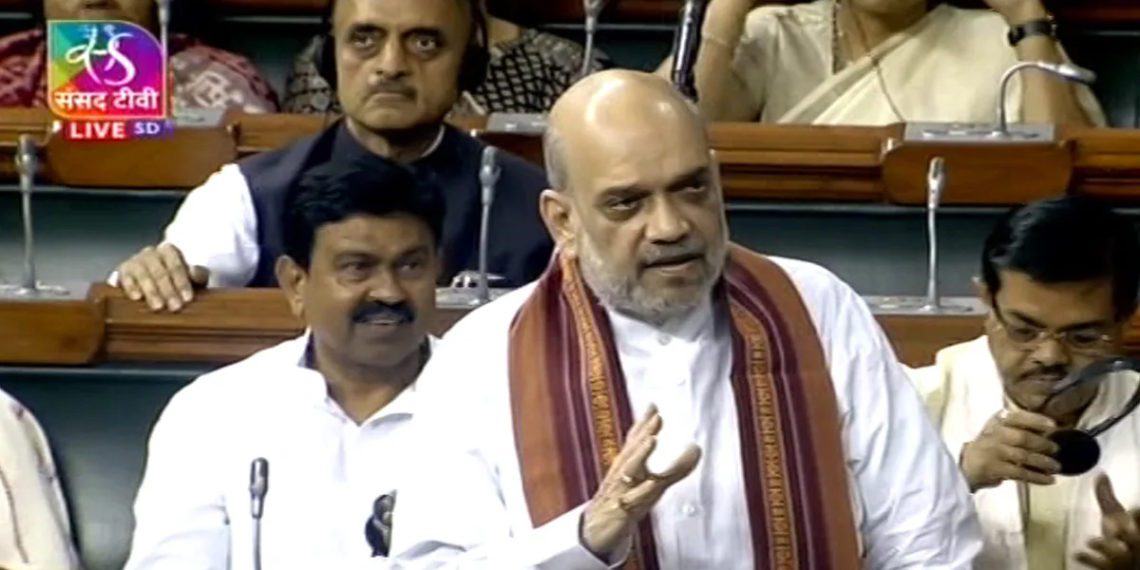

In a written reply to a question in the Lok Sabha Minister of Cooperation, Amit Shah listed the benefits accruing to co-ops in the wake of several new measures taken by the govt.

The govt agency notes” In order to realize the vision of ‘Sahakar se Samriddhi’, recently, the Government has taken following steps to provide relief to the Cooperative Societies which includes reduction of tax on various activities and increasing the threshold for TDS on cash withdrawal by them:

1. Reduction in surcharge on cooperative societies

The surcharge on co-operative societies has been reduced from 12% to 7% on income of more than Rs 1 crore and up to Rs 10 crores. This would help in enhancing the income of cooperative societies and its members who are mostly from rural and farming communities.

2. Reduced Alternate Minimum Tax rate for cooperatives

Cooperative societies were required to pay Alternate Minimum Tax at the rate of 18.5%. However, companies paid the same at the rate of 15%. To provide a level playing field between co-operative societies and companies, the rate for the cooperative societies have also been reduced to 15% for cooperative societies.

3. Clarification in respect of section 269ST

Section 269ST restricts cash receipts in excess of Rs 2 lakh from (a) any person in a day; or (b) from any transaction; or (c) from multiple transactions in respect of single event or occasion. In case of violation of this provision, penalty for the amount in contravention of section 269ST is levied under Income Tax Act 1961. For payment of milk price to their members, Milk Cooperative Societies receive cash, in excess of ? 2 lakh across multiple days in a year, particularly on the bank holidays, from a distributor, with whom they have contract. Resultantly, huge penalties were levied on the Milk Societies by Income Tax Department by treating contract between Cooperative Societies with its distributor as one event / occasion. CBDT vide Circular No 25/2022 dated 30.12.2022 issued clarification that in respect of cooperative societies, a dealership / distributionship contract by itself may not constitute an event or occasion for purpose of clause (c) of the section 269 ST. Receipt related to such a dealership / distributionship contract by the cooperative society on any day in a previous year, which is with in prescribed limit may not be aggregated across multiple days for that previous year. This would enable Cooperative Societies to make payments to their members, who are mostly from rural and farming communities, on bank holidays without fear of income tax penalty.

4. Concessional rate of tax for new manufacturing cooperative societies

The new co-operatives that commence manufacturing activities till 31.03.2024 shall get the benefit of a lower tax rate of 15 %, as is presently available to new manufacturing companies.

5. Relief for cash loan/transactions by primary co-operatives

As per Section 269SS of the Income Tax Act, 1961, any deposit or loan of more than Rs 20,000 in cash is not allowed. Violation can invite a penalty equal to the loan or deposit amount. Section 269SS of the Income Tax Act has been amended to provide that where a deposit is accepted by a Primary Agricultural Credit Society (PACS) or a Primary Co-operative Agricultural and Rural Development Bank (PCARDB) from its member or a loan is taken from a PACS or a PCARDB by its member in cash, no penal consequence would arise, if the amount of such loan or deposit including their outstanding balance is less than Rs 2 lakh. Earlier this limit was ? 20,000 per member.

6. Relief for repayment of loan in cash by primary co-operatives

As per Section 269T of the Income Tax Act, repayment of the loan or deposit of Rs 20,000 or more in cash is not allowed. Violation can invite a penalty equal to the loan or deposit amount. Section 269T of the Income Tax Act has been amended to provide that where a deposit is repaid by a PACS or a PCARDB to its member or such loan is repaid to a PACS or a PCARDB by its member in cash, no penal consequence shall arise, if the amount of such loan or deposit including their outstanding balance is less than Rs 2 lakh. Earlier this limit was Rs 20,000 per member.

7. Increasing threshold limit for co-operatives to withdraw cash without TDS

A higher limit of Rs 3 crore for TDS on cash withdrawal has been provided to co-operative societies.

8. Relief to sugar cooperatives by providing deduction on account of the amount incurred for purchase of sugarcane.

Through Finance Act 2015, Section 36(1)(xvii) was inserted in Income Tax Act 1961 to provide for deduction on account of the amount of expenditure incurred by a cooperative society engaged in the business of manufacture of sugar. The clause took effect from 01.04.2016 i.e., assessment year 2016-17. However, the issue of treatment of additional payment for sugarcane price by Cooperative Sugar Mills (CSMs) as an income distribution to farmer members and resultant tax liabilities remained uncovered which was clarified by Central Board of Direct Taxes vide Circular No 18/2021 dated 25.10.2021. Accordingly, resultant tax liabilities on CSMs on additional payment for sugarcane price by them were mitigated w.e.f. 1.4.2016.

9. Relief to sugar co-operatives from past income tax demand

An opportunity has been provided to sugar co-operatives to claim payments made to sugarcane farmers for the period prior to assessment year 2016-17 as expenditure. Accordingly, section 155 of the IT Act has also been amended to insert a new sub-section (19) vide Finance Act, 2023, w.e.f. 1st April 2023. In order to standardize the manner of filing application to the Jurisdictional Assessing Officer under sub-section (19) of section 155 of the Act and its disposal by the Jurisdictional Assessing Officer under the said section, CBDT vide Circular No. 14 of 2023 dated 27.07.2023 has issued Standard Operating Procedure for making application by the concerned Cooperative Sugar Mills. This has resolved the income tax issues in this matter pending for decades. This is expected to provide relief of almost Rs 10,000 crore.

10. Condonation of delay under clause (b) of sub-section (2) of section 119 of the Income Tax Act, 1961 (IT Act) for returns of Income claiming deductions u/s 80P of the Act for various assessment years from AY 2018-19 to AY 2022-23

CBDT vide circular no. 13/2021 dated 26 July 2023 has authorized Chief Commissioners of Income-tax (CCsIT) / Directors General of Income-tax (DGsIT) to deal with applications of condonation of delay from cooperative societies, who were unable to avail the benefit of deduction available under section 80P of the IT Act on account of delay in furnishing the return of income within the due date under sub-section (1) of section 139 of the Act for various assessment years from AY 2018-19 to AY 2022-23 and the delay was caused due to circumstances beyond their control or due to delay in getting the accounts audited by statutory auditors appointed under the respective State Law.