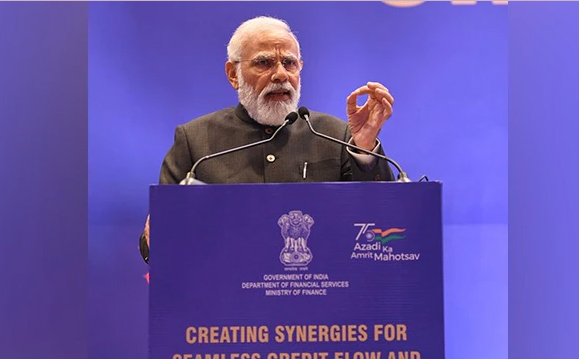

Addressing the concluding session of the conference on ‘Creating Synergies for Seamless Credit Flow and Economic Growth via the video conference, Prime Minister urged banks to shed the feeling that they are benefactors and customers their supplicants but they should see themselves as givers and clients as recipients. The banks would have to adopt the model of the partnership said, Shri Modi.

The conference was attended by several captains of cooperatives including IFFCO MD Dr. U S Awasthi and MD of Amul (GCMMF) R S Sodhi, among others.

Commenting on the PM’s speech, IFFCO MD wrote “Today’s address by PM Shri Narendra Modi ji on ‘Building Synergy for Seamless Credit Flow & Economic Growth’ was very inspiring. Every professional should listen to it. Attended the symposium with Shri R S Sodhi, MD Amul on the left side & Debjani Ghosh, President of NASSCOM on right”.

Speaking on the occasion the PM said “We addressed the problem of NPAs recapitalized banks and increased their strength. We brought reforms like IBC, reformed many laws, and empowered the debt recovery tribunal. A dedicated Stressed Asset Management Vertical was also formed in the country during the Corona period” Shri Modi said

“Indian banks are strong enough to play a major role in imparting fresh energy to the country’s economy and in making India self-reliant. I consider this phase as a major milestone in the banking sector of India”, he underlined

NPA in public sector banks is at the lowest in the last five years. This has led to the upgrading of the outlook for the Indian Banks by International agencies, the prime minister said asking the banking sector to support wealth and job creators.

The Prime Minister said that banks should have stakes in the growth of all the stakeholders and proactively get involved in the growth story. He gave an example of PLI where the government is doing the same by giving Indian manufacturers an incentive on production. Under the PLI scheme, the manufacturers have been incentivized to increase their capacity manifold and transform themselves into global companies.

He listed the opportunities presented by the flagship schemes like PM Awas Yojana, Swamiva, and Svanidhi and asked the banks to participate and play their role in these schemes.

Speaking on the overall impact of financial inclusion, Shri Modi said that when the country is working so hard on financial inclusion, it is very important to unlock the productive potential of citizens. He gave an example of recent research by the banking sector itself where more Jan Dhan accounts opened in states have led to a reduction in the crime rate.

Similarly, the Prime Minister said the scale at which corporates and start-ups are coming forward today is unprecedented. “In such a situation, what can be a better time to strengthen India, fund, invest in India’s aspirations?”, the Prime Minister asked.

The Prime Minister called upon the banking sector to move by attaching themselves with national goals and promises. He praised the proposed initiative of web-based project funding tracker to bring together ministries and banks. He suggested that it will be better if it is added to the GatiShakti Portal as an interface. He wished that in the ‘Amrit Kaal’ of independence, the Indian banking sector will move with big thinking and Innovative approach.