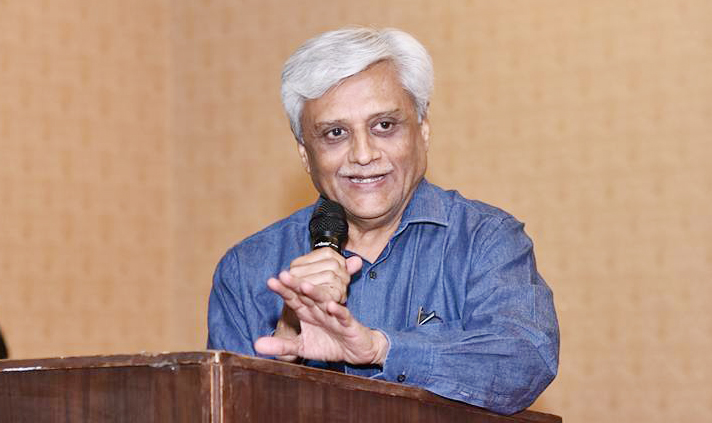

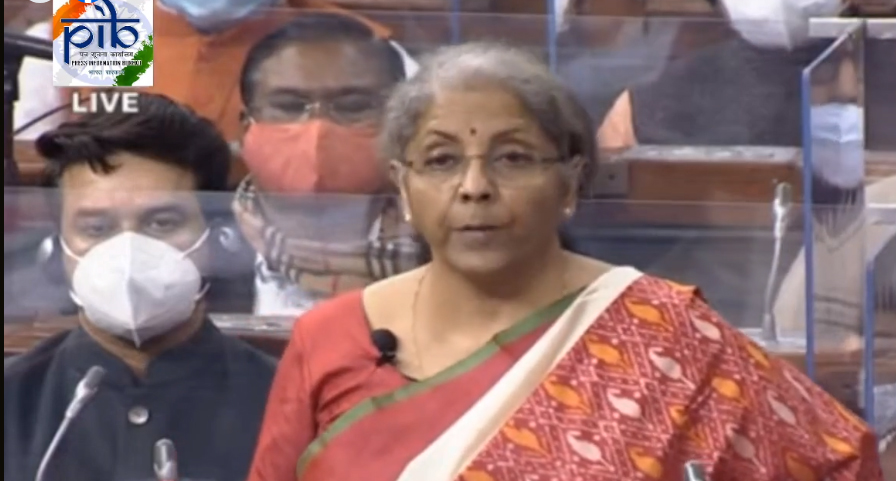

Welcoming the Union Budget 2021 presented by Union Finance Minister Nirmala Sitharaman, Nafcub President Jyotindrabhai Mehta has particularly hailed the announcement made by the minister on making a Separate Administrative Structure to streamline the ‘Ease of Doing Business’ for Cooperatives.

“It is a long pending demand of the cooperative sector which is being fulfilled by the Honorable Finance Minister. We are very thankful and this announcement will strengthen the cooperative sector”, he added.

Mehta also reacted to the statement on Amendments to the DICGC Act, 1961, to help depositors get easy and time-bound access to their deposits to the extent of the deposit insurance cover.

He added that the para on DICGC says that the Act will be suitably amended so that if a bank is temporarily unable to fulfil its obligations, the depositors of such a bank can get easy and time bound access to their deposits to the extent of deposit insurance cover. This is good news for the Banking sector which means that DICGC can be a partner in the revival of the bank”.

“The existing provision was that DICGC could put in money only in a merger with another UCB Or DICGC but was not able to make payments to the depositors until the Bank was taken into liquidation”, his comment reads.

The Union Finance Minister said, Minimum loan size eligible for debt recovery under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 proposed to be reduced from Rs. 50 lakh to Rs 20 lakh for NBFCs with minimum asset size of Rs. 100 crore.