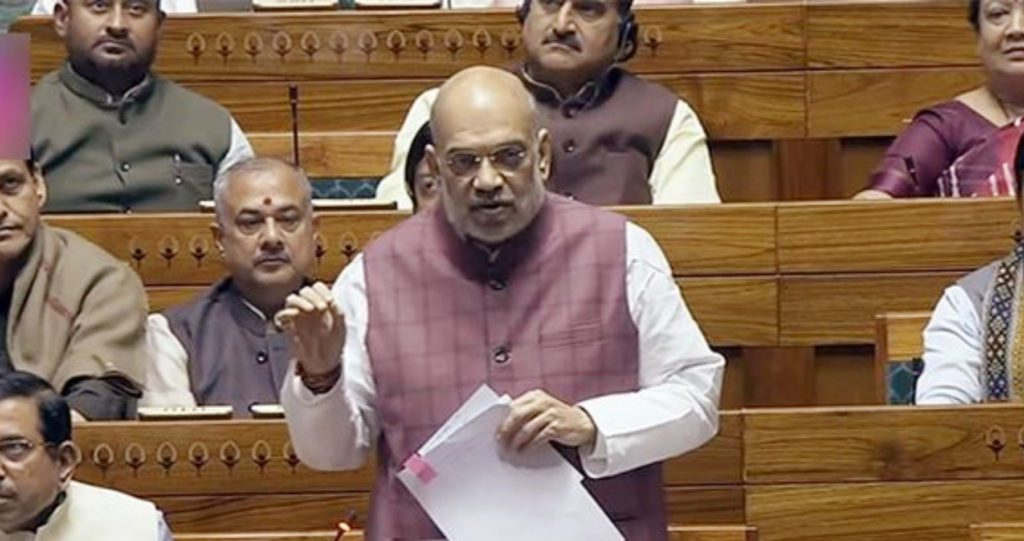

Union Home and Cooperation Minister Amit Shah informed the Rajya Sabha that the Reserve Bank of India (RBI) has been requested to relax the eligibility criteria for State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs) to align them with the revised criteria applicable for Regional Rural Banks (RRBs).

This move aims to expand digital banking services in rural areas through the extensive network of StCBs and DCCBs.

Highlighting the current scenario, Shah stated, “Considering the need to further promote the spread of digital banking in rural areas through the extensive network of StCBs/DCCBs and the low number of StCBs/DCCBs offering internet banking with transaction facilities, the RBI has been approached for a review of eligibility criteria,” he said.

As of now, only 4 out of 34 StCBs offer internet banking with transaction facilities, and 21 provide mobile banking. Among the 351 DCCBs, only 8 offer internet banking with transaction facilities, while 113 provide mobile banking. Notably, StCBs and DCCBs were prohibited from offering internet banking services until 2015.

To promote digital banking, the RBI issued a notification on November 5, 2015, allowing StCBs and DCCBs meeting specific eligibility criteria to apply for internet banking licenses. Similarly, mobile banking services were permitted for eligible StCBs and DCCBs from October 8, 2008.

Additionally, NABARD has played a pivotal role in modernizing the cooperative banking sector by bringing all Regional Cooperative Banks (RCBs) onto the Core Banking Solution (CBS) platform.

Through a special initiative, 201 RCBs (14 StCBs and 187 DCCBs) from 16 states and 3 union territories, with a total of 6,953 branches, joined the NABARD-initiated CBS Project using a cloud-based Application Service Provider (ASP) model. This effort has significantly enhanced the digital infrastructure of cooperative banks, paving the way for improved banking services in rural areas.