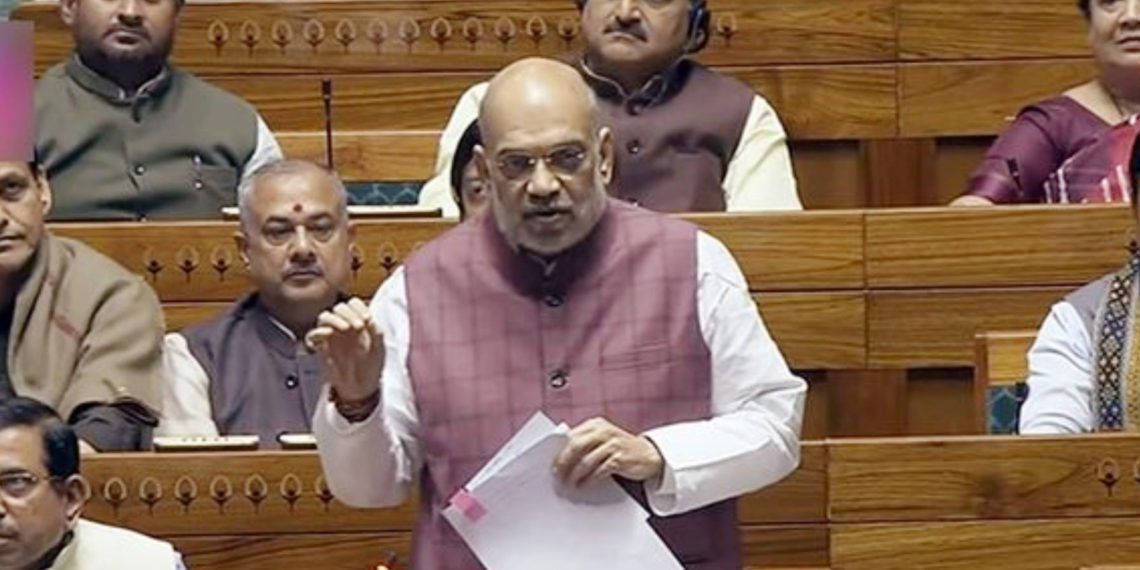

Union Home and Cooperation Minister Amit Shah informed the Rajya Sabha that the Reserve Bank of India (RBI) has been requested to relax the eligibility criteria for State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs) to align them with the revised criteria applicable for Regional Rural Banks (RRBs).

This move aims to expand digital banking services in rural areas through the extensive network of StCBs and DCCBs.

Highlighting the current scenario, Shah stated, “Considering the need to further promote the spread of digital banking in rural areas through the extensive network of StCBs/DCCBs and the low number of StCBs/DCCBs offering internet banking with transaction facilities, the RBI has been approached for a review of eligibility criteria,” he said.

As of now, only 4 out of 34 StCBs offer internet banking with transaction facilities, and 21 provide mobile banking. Among the 351 DCCBs, only 8 offer internet banking with transaction facilities, while 113 provide mobile banking. Notably, StCBs and DCCBs were prohibited from offering internet banking services until 2015.

To promote digital banking, the RBI issued a notification on November 5, 2015, allowing StCBs and DCCBs meeting specific eligibility criteria to apply for internet banking licenses. Similarly, mobile banking services were permitted for eligible StCBs and DCCBs from October 8, 2008.

Additionally, NABARD has played a pivotal role in modernizing the cooperative banking sector by bringing all Regional Cooperative Banks (RCBs) onto the Core Banking Solution (CBS) platform.

Through a special initiative, 201 RCBs (14 StCBs and 187 DCCBs) from 16 states and 3 union territories, with a total of 6,953 branches, joined the NABARD-initiated CBS Project using a cloud-based Application Service Provider (ASP) model. This effort has significantly enhanced the digital infrastructure of cooperative banks, paving the way for improved banking services in rural areas.

Dear respected sir please merge all DCC Bank with their State co operative apex bank

Merger of DCBs with SCBs is the need of hour for better ment of co-operative system

Merger will act as the key component to compete with the other banks and most of all provide better services and transparency to the customers. Many facilities has to implemented in bank systems for that merger will be very necessary to act as one.

RBI and NABARD have allowed these coop banks with more liberty and less control. Just to encourage the coop system the RBI and NABARD are still following the very old slogan ‘coops have failed but have to succeed. But how many more years you will tollerate this sort of running the St and Dt coop banks. You announce a time within which they have to do or die. Do not allow them to be with this illhealth or coma stage living. You have given the sufficiemt time of around 90 years with paper threats. Administer them like RRBs which came in 1976 with professional Directors. RRBs are now competing with their Sponsor banks because of these professional Directors who follow the directions, policies, guidelines of RBI & NABARD for their developments and not like coops who knowingly well violate the rules, policies and run according to the wishes, Ideas of their. Leaders. Pl do not have softcorners to any institutions which are violating the rules, laws, directions, guidelines. Make Boards fully professionals like commercial banks snd RRBs. Make the Board and the Administrators responsible for their flaws, mistakes, viloations, selfish decisions, favouritisms etc. This is the only solution for correcting the current coop health. Softcorner policy to coops has utterly falied Be strong if you have to correct the system. I hope you will.