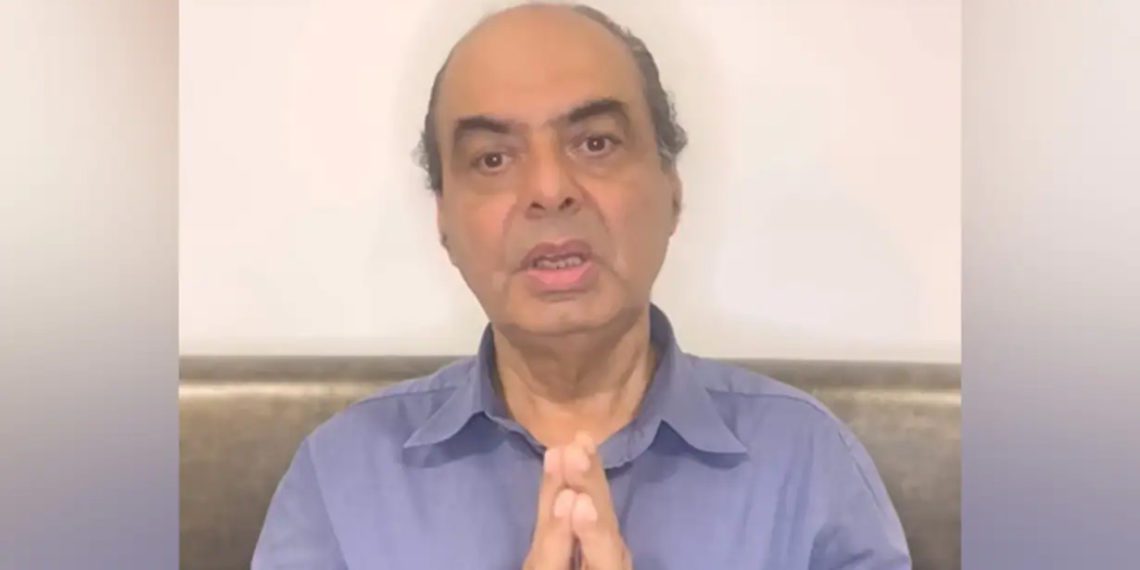

Ex-chairman of Seva Cooperative Bank Amar Moolchandani was arrested in the case of swindling of fund amounting to Rs 494 crore.In a dramatic unfolding of events, Moolchandani was found locked in a servant quarters in the premises of his residence near Pune.

It bears recalling that the RBI had cancelled the licence of “The Seva Vikas Co-operative Bank Ltd., Pune, Maharashtra, consequently, the bank ceases to carry on banking business, with effect from the close of business on October 10, 2022.

The Reserve Bank cancelled the licence of the bank as the bank does not have adequate capital and earning prospects. RBI further said “The bank with its present financial position would be unable to pay its present depositors in full; and public interest would be adversely affected if the bank is allowed to carry on its banking business any further.”

As per the data submitted by the bank, about 99% of the depositors are entitled to receive the full amount of their deposits from DICGC. As on September 14, 2022, DICGC has already paid Rs 152.36 crore of the total insured deposits under the provisions of Section 18A of the DICGC Act, 1961 based on the willingness received from the concerned depositors of the bank, reveals RBI release.