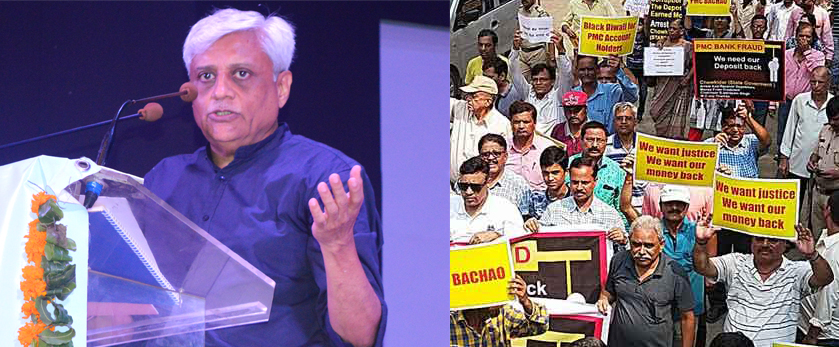

Aghast at the RBI’s move to go ahead with the PMC merger, the President of the apex body of Urban Cooperative Banks and Credit Societies of India- Nafcub Jyotindra Mehta said it is nothing less than a travesty of justice.

Mehta specifically raised three points in this connection. Why was the BR Act Amendment 2020 enacted recently if PMC’ss helpless depositors were not to be benefitted, why was the DICGC Act was not amended to suitably help them, and finally why there was no cognizance of the suggestions given to the RBI when it asked for the same from the public.

Mehta said that a core committee meeting is being organized to discuss the serious situation which has emerged due to the raw deal meted to the depositors by the RBI. “We stand with depositors with full strength as we are very well aware that UCBs will exist only till the depositors are a happy lot”, added Mehta painfully.

Elaborating, Mehta said “The Central Government amended the Banking Regulation Act with an objective to help the PMC depositors. The amendment gave RBI absolute power. But the notification released by the RBI in regard to the PMC Bank, prior to Republic Day, hardly proves this as the objective of amendment lies in tatters”, he added.

There is an urgent need to help the victims of PMC Bank by amending the Deposit Insurance and Credit Guarantee Corporation Act. According to the existing act, the DICGC gives the insured amount to the depositors of banks under liquidation. But the PMC case is queer as it

is neither this nor that. It is a case of a merger where DICGC does not intervene leaving the depositors high and dry, felt Mehta. “Govt must amend the Act to help victims of the PMC Bank”, Mehta asserted.

The NAFCUB President was also aghast at the RBI’s indifference towards those who gave suggestions on the merger. Readers would recall that when RBI came out with the draft scheme for the merger of the sick Punjab and Maharashtra Cooperative (PMC) Bank with the Unity Small Finance Bank, it asked the reactions from the public.

In this regard, thousands of people gave their reactions and voted against the scheme but the RBI took no cognizance of them and went ahead with its original plan. Indian Cooperative had also published several such suggestions given by the stakeholders.

As per the notification of the Scheme for the amalgamation of the PMC Bank, for those with more than Rs 5 lakh in deposits, the payout for the additional amount will be made in a staggered manner.

Up to Rs 50,000, the payment will be made over the next one year, for more than Rs 50 k and less than Rs 1 lakh, the payment will be made after three years. Those having deposits of more than Rs 1 lac to Rs 2.5 lac, payment will be made after four years and those above till Rs 5.5 lakh, the time frame will be more than five years, and anyone having more than this, will get payment after 10 years.

Depositors are aghast at the injustice, said Mehta

Daylight back stabbing & Breach of trust by RBI by blatantly misusing the powers covering up their own regulative negligency to make the innocent stakeholders suffer miserably is totally against the principles of natural justice. Immediate suo-motu action by judiciary required. This can not be the law of land.

RBI acknowledged but ignored whistleblower report of 2011. Shows RBI was aware and most likely complicit in this fraud. It’s own auditor LM Kamble took a plumb position in PMC bank after retirement without following mandatory guidelines and rbi pretends it wasn’t aware what’s happening. Now RBI commits crime all over again by handing over everything to Unity on a platter, even now serious governance issues of Centrum-Bharat Pe founders are available in public domain. Who is RBI serving? Depositors or Fraudsters? Is this how GOI allows RBI to abuse powers? Why aren’t RBI auditors jailed for life? Since RBI is at fault, why aren’t their reserves and investor protection fund used to make good the losses of PMC depositors? Why no interest from day 1 after amalgamation at current interest rates of Unity SFB? So many whys and all against the common depositors proves RBI is not a regulator but is working only in the interest of fraudsters and future fraudsters. Is India a democracy that will ensure timely justice to PMC depositors? Is RBI bigger than India and Indians? Dismantle RBI completely if it cannot fulfill its objectives of regulatory oversight, lender of last resort, audit, etc. Take away all powers related to these roles from the RBI. And use RBI reserves to pay depositors affected by fraud.

Its breach of trust by RBI.People were attracted to this PMCBank through out India just due to RBI ‘s certificate and grading.RBI purposely ignored wring doings in the Bank may be due to it’s corrupt officers who had hands in gloves with the fraudsters and instead of booking and punishing concerned culprits RBI punishes innocent depositors who deposited their life time savings and hard earned money in the bank.

This story I write as now… There was a unmarried couple centrum and Bharat pe wanted a Rajkumar son i.e. Small finance Bank. They went to RBI pandit. RBI told them it may take 5 years not sure you get kingdom too. And Pandit RBI Saw a sick king PMC bank.hence suggested both of you marry produce a immature child in hurry 7 moths . I will compel sick king PMC to adopt your child. you get rajkumar son kill pmc name it unity leave praja depositors . Accept palace and king dome starve praja to death so that you can enjoy there property too. By Rakesh Singh ex Indian Navy n depositor.

No justice, our money in the bank and someone else enjoys, after 10 years what will be the value of our money.

Amalgamation plan prepared by RBI and approved without any changes is indication that ,we as RBI & Govt care dam about your suggestion and objections.

They have also not cared about Sahakar Bharti or NAFCUB.

This amalgation plan is not only death warrant for PMCB but all Urban cooperative banks.

Now every citizen must think before putting money in bank especially co-operative banks

It appers that Govt and RBI do not want to protect depositors above Rs 5.00 L in co-operative banks. They have also shown their incompetence & unaccoutability towards depositors of co-operative banks.

It is shame on RBI & Govt that inspite of death of 250 depositors , want frauds to continue in bank & kill inocent depositors because they have deposited money in co-operative bank.

RBI is useless body….why they asked for suggestions when they have not incorporated about of it? Cruel RBI

BURYING TAX PAYING DEPOSITORS AND USURPING THEIR SAVINGS IN A RATED BANK. RIDDICULOUS TERMS OF 10 YEARS NO INTEREST.

WHILE FOR DECADES THEY HAVE COLLECTED TAXES IN ADVANCE ON THESE VERY SAVINGS.

IMMEDIATE INTERVENTION BY SUPREME COURT IS THE NEED OF THE HOUR.

CONSTITUTION AND EVERY COMMON WORKING CLASS PERSON IS IN DANGER IN INDIA UNDER CURRENT CORRUPT GOVERNMENT.

RBI is not bothered about Sahakar Bharti or Nafcub

And do not want to take any suggestions from them.

Depositors are being penalised for investing in fixed deposits with PMC bank on the basis of rating given by RBI. Please let us know what action RBI has taken against it’s officials / auditors, who have ignored the whistleblower and given highest investment rating to PMC. Why this amalgamation process is not focusing on this issue? Further, DICGC is funding initial Rs.5 lacs per customer. No interest will be given w.e.f.31/03/21 on deposits. Then why amalgamation is required? Only to handover all assets of e-PMC to Unity SFB. RBI, through its administrator, would have sold all the PMC assets and HDIL assets and would have distributed the amount to depositors/stake holders in % terms. Further, what is the guarantee that Unity SFB will run for further 5-10 years. Whether RBI is taking the guarantee for refund of deposits if Unity SFB fails to do so.

Depositors are being penalised for investing in fixed deposits with PMC bank on the basis of rating given by RBI. Please let us know what action RBI has taken against it’s officials / auditors, who have ignored the whistleblower and given highest investment rating to PMC. Why this amalgamation process is not focusing on this issue? Further, DICGC is funding initial Rs.5 lacs per customer. No interest will be given w.e.f.31/03/21 on deposits. Then why amalgamation is required? Only to handover all assets of e-PMC to Unity SFB. RBI, through its administrator, would have sold all the PMC assets and HDIL assets and would have distributed the amount to depositors/stake holders in % terms. Further, what is the guarantee that Unity SFB will run for further 5-10 years. Whether RBI is taking the guarantee for refund of deposits if Unity SFB fails to do so.

If Unity SFB can give a whopping 7%interest to new depositors, why not to the pmc depositors whose money actually forms their seed capital?

Retail depositors are actually creditors, and here, they are looting their benefactors!!!

If Unity SFB can give a whopping 7%interest to new depositors, why not to the pmc depositors whose money actually forms their seed capital?

Retail depositors are actually creditors, and here, they are looting their benefactors!!!

In a country where human respect is an unknown terminology, where government and administration are deaf, dumb, insensitive and shameless there exchanging of notes and comments amongst ourselves will be of what use?

Here nothing but direct action on the streets like the farmers did, work. But in our case it won’t be possible because our number is small, many are senior/very senior citizens and MOST IMPORTANTLY THERE IS NO POLITICAL SUPPORT BECAUSE AS VOTE BANK WE DON’T COUNT

So only one small hope is to knock the door of Supreme Court. However given the way our judicial system work, hope of any remedy is very very remote

Better we bycott loksabha election forever

It appers that the amalgamation plan given by RBI for PMCB is clear indication of following.

1- RBI has no concern for hardship of innocent stakeholders of PMCB.

As 35 A was extended for last 28 months & 250+ depositors died, but RBI being autocratic have not shown any serious concern

2- The purpose of amending B R Amendment act was to bring UCB at par with other commercial bank. But in practice PMCB is treated as black sheep.

3-As per section 45, RBI have invited objections and suggestions from from all stake holders. The Apex body like Sahakar Bharti & Nafcub have also have given their views in interest of PMCB stake holders and larger interest of UCBs but it was set aside This shows admant attitude of RBI.

4- The terms of amalgation are total indication of giving 3000 cr liquedity of PMC bank in charity to UNITY. Only Rs 2500 cr will requred to pay Rs 4000 cr as it is spread over 10 years without interest or nominal interest

On other side UNITY have offered 7% saving bank interest to retain depositor’s DICGC amount of Rs 4000 cr.

The assets of PMCB of 800 cr will also used free of cost.

The secured loan recovery of Rs 1455 cr +Rs 2500 cr basic loan recovey of HDIL will be used as provision money of Rs 1150 cr for DICGC and 1300 cr for institutional depositors respectively.

Now from above it is clear that this is less amalgamation and more charity to UNITY.

This amalgamation plan is foot print of killing PMCB and UCB

IF Sahakar Bharti & Nafcub do not stop implementation of this plan ,it will be digging grave yard for PMCB now and other UCB in future.