The RBI guidelines for the amalgamation of urban cooperative banks have mostly been welcomed by the urban cooperative banking fraternity. In particular, they have appreciated the clause that the merger is possible only when the two-third of Board members give the idea the go-ahead. The fact that the merger proposal is to be passed the General Body also insulates the bank against any danger, they felt.

Excerpts:

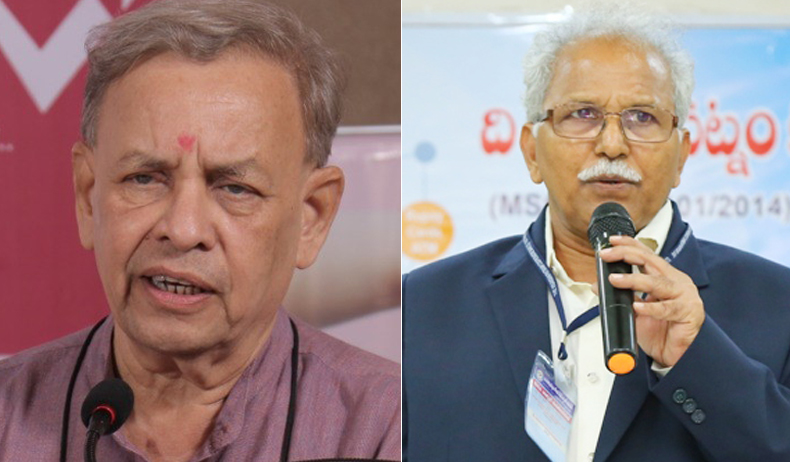

Satish Marathe, RBI Central Board Director and Sahakar Bharati Senior Leader

A timely move to Protect interests of the Depositors. It also provides Exit Route to dissenting Shareholders.

Simultaneously, it provides a Non-Disruptive channel for Stressed UCBs and to those UCBs who may not be willing or are not equipped to face the emergent challenging scenarios. A Welcome Initiative!

Raghvendra Rao Chalasani, Chairman, Visakhapatnam Cooperative Bank

RBI issuing transparent guidelines with emphasis on shareholders meeting approval of both amalgamated and amalgamating banks being primary requisite is welcome. However, it is necessary to ensure that amalgamation of banks are on a voluntary basis and not at the instance of RBI.

The Cooperative character of the institutions being merged should be protected. The role of RBI should at best be one who suggests. As regards incentivising Amalgamating UCB, it would be useful if along with State Govt. or by themselves, DICGC contributes a portion of the loss of a UCB that is being amalgamated.

The amount of such contributions can be the total premium paid by a UCB, which is having accumulated losses during their existence. This will help in non-disruptive exit of loss making UCBs.

William D’Souza, Former CEO, Model Cooperative Bank

It is a very good move by RBI. When 2-3 good cooperative Banks get amalgamated they become much stronger and can face the stiff competition from Small Finance Banks and Pvt Sector Banks. Amalgamated strong co-op Banks can invest in Technology & infrastructure and can offer all the digital Banking offered by Small Finance Banks and Pvt Sector Banks. Even the RBI knows that Co-op Banks offer best services to a common man. Overall it is a very good move by RBI for the benefit of the co-op Sector.

Subhra Jyoti, CEO, Industrial Cooperative Bank

This looks a pragmatic move by RBI but the umbrella organisation would have a better solution to it. In today’s technology era, these grassroots banks need to be strengthened but they don’t have capital to do that kind of investment.

Hence the amalgamation is one of the solutions to increase the capital base. At the same time, the involvement of manpower in those institutions is also a challenge because of its scale of operation. Thirdly, it is obvious that RBI will reduce its work load by reducing the number at the cost of the social strengths and contributions to society by those UCBs.

M K Nayak, President Cuttack Credit Cooperative Society

Weak Urban banks should make necessary arrangements for amalgamation with big sized n well managed U C Banks. We welcome this step of RBI.

According to RBI, its approval for the amalgamation could be achieved when the net worth of the amalgamated bank is positive and the amalgamating bank assures that it will protect deposits of all the depositors of the amalgamated bank.

Secondly, when the net worth of amalgamated bank is negative and the amalgamating bank on its own assures of protecting deposits of all the depositors of the amalgamated bank.

And thirdly, when the net worth of the amalgamated bank is negative and the amalgamating bank assures of protecting the deposits of all the depositors of the amalgamated bank with the financial support from the State Government extended upfront as part of the process of merger.