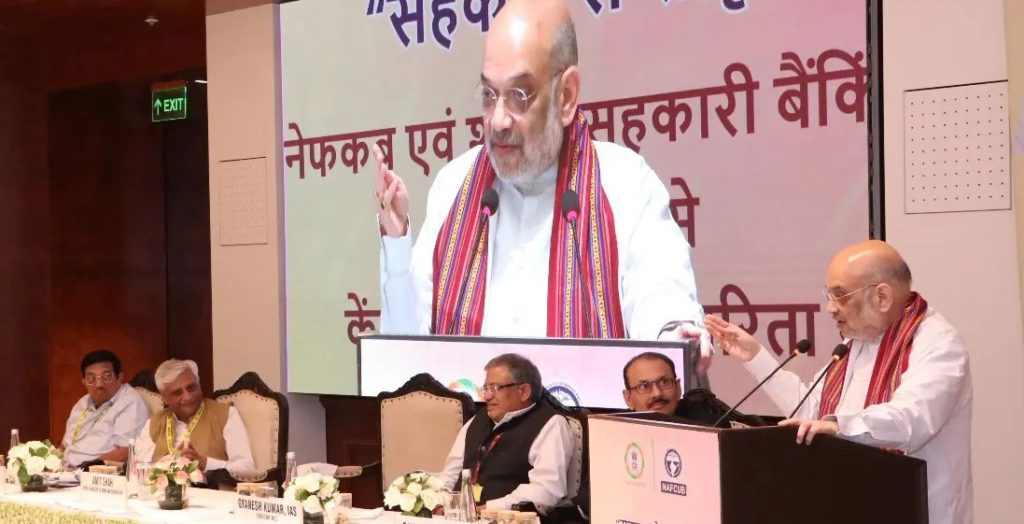

Sensing the unwillingness of a section of UCB in accepting the new amendments in the BR Act, Amit Shah asked them to adopt it wholeheartedly underlining that transparency and professionalism are factors which can help the sector survive. Shah was speaking at Bharat Mandapam in Delhi on Thursday on the occasion of UCBs’ leaders thanks-giving event.

“Trust me the new Act is just like Quinine tablets which will remove the long-term ailment of the sector,” Shah exhorted the delegates saying that young professional boys should be inducted in the UCB sector to make it truly professional and competitive.

Shah also gave a target to the leaders to double the business to Rs 11 lac in the next five years. You have to think of ways to develop= business and Nafcub should help you in this, said Shah, adding that UCBs should give loans to small borrowers also. “I have also worked with a co-op bank and my experience tells me that the issue of NPAs does not arise with small borrowers” said Shah.

Stressing on the need to have a co-op bank in each district, Shah asked the leaders and the Nafcub Directors to give it a serious thought. Find out nearby successful co-op societies in each district and set up a bank as only UCBs can help the downtrodden of society in an unprecedented manner, said Shah.

Shah also made two important announcements on this occasion. He said as is the case with the PSUs, one

Underlining cooperation between co-ops, Shah mentioned a pilot project launched in two districts of Gujarat– Panchmahal and Banaskatha where all the PACS, fisheries co-ops and dairy co-ops have begun to transact banking operations in the DCCBs. Revealing the figure, he said that there was a flight of more than Rs 30,000 crore from SBI branches in these areas.

Earlier, Nafcub President Jyotindra Mehta said that he has shortage of words to thank Shah and that the sector should do its bit not to disappoint Shah who has done so much. Mehta also recounted how Amit Shah’s team led by Secretary Gyanesh Kumar would call them often to discuss our issues.

“They understood our issues so well that when it came to discussion with the RBI, more than us, these officials were arguing on our behalf”, said Mehta amidst huge applause.