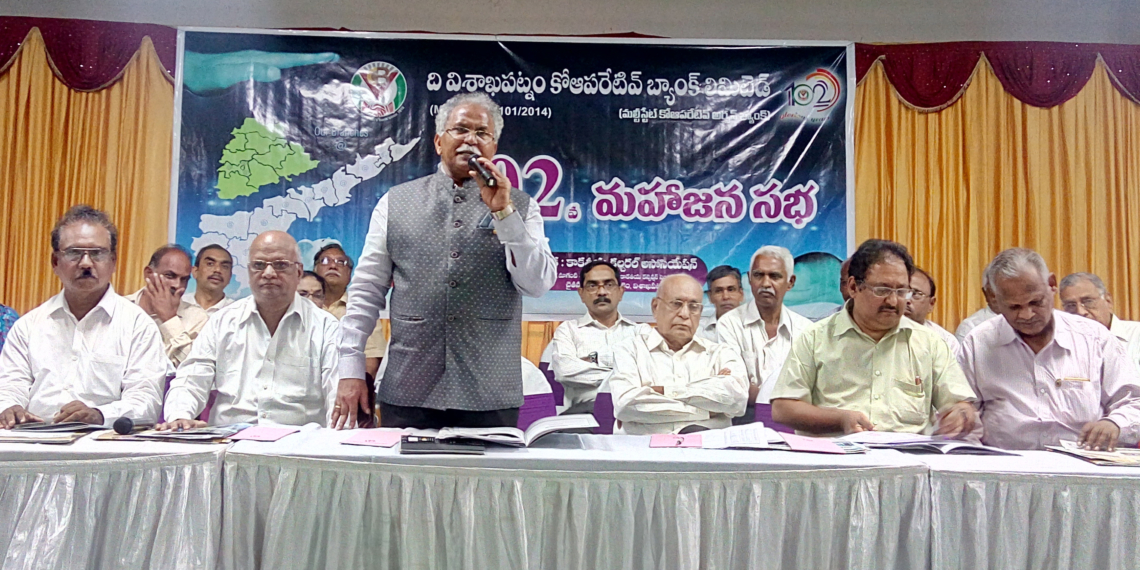

The biggest urban cooperative bank of South India-The Visakhapatnam Cooperative Bank Ltd has registered improvement on all indices- like deposits, profit and reduction in NPAs, informed a jubilant Chairman Raghvendra Rao during AGM on Sunday.

The UCB’s deposits rose from Rs 2532 crore to Rs 2731 crore and its NPA came down to 1.54% from 1.89 percent compared to the last year. It also had a rise in its profit from Rs 31 crore to Rs 34 crore.

Talking about its future plans, the Chairman said “attaining scheduled status and opening new branches are top priorities”. The application for Scheduled status of the Visakhapatnam Cooperative Bank is pending with RBI, informed Chalasani Raghavendra Rao, Chairman.

The Bank is presently operating in 13 districts of Andhra Pradesh with 46 branches and 4 branches in Hyderabad, Telangana State making a total of 50 branches. In the financial year 2016-17. the bank had 45 branches, and by the end of the financial year 2017-18 the bank has 50 branches -a milestone in the bank’s expansion.

The Bank has opened 46th branch in Danavaipeta, Rajamahendravaram, 47th branch in Vijayawada One Town, 48th branch in Guntur One Town, 49th branch in Atchyuthapuram , Visakhapatnam District and 50th Branch in Dilshuknagar, Hyderabad, read a press release signed by CEO Mr P V Narsimha Murthy.

Over last 35 years, the bank has registered humungous progress, from Rs 2.91 crs business (deposits and loans) in 1984-85 has grown to Rs 4701.21 crs in 2017-18. The total members of 3661 with share capital of Rs 9 lakhs in 1984-85 have grown to 75298 members with share capital of 193.48 crs share capital in the year 2017-18 and thus it has become the biggest cooperative urban bank in South India.

Reacting on the issue of RBI’s circular on BoM/BoD, the Chairman Emeritus of the Bank and Director NAFCUB Manam Anjaneyulu Garu saidthat the entire sector disapproves the idea of having two bodies managing the affairs of urban cooperative banks.

On its own admission in the publication “Trends and Progress of Banking,” RBI states that urban cooperative banks have outperformed commercial banks across many parameters including the ones relating to bad debts and gross NPAs, said Anjaneyulu.

Though there’s considerable rise in the profits and nominal percentage of NPAs the Bank could declare nominal dividend only to its shareholders i.e., @ 12%.

The rate of interest on deposit needs upward revision.

Basing on the overall performance Congratulations to the all those heading the institution.

Congratulations to you ,your team and staff Raghavendra Rao Garu.