The investors and depositors associated with the scam-ridden Punjab and Maharashtra Cooperative Bank have reacted with shock and pain at the RBI’s notification allowing Unity Small Finance Bank to take over the PMC Bank and start conducting the business.

They have criticized both the Central Government as well as the Reserve Bank of India for not giving relief to them. Several of them took to social media to react to the notification released by the RBI a day prior to Republic Day. Many of them have sent their reactions to Indian Cooperative on WhatsApp. We are reproducing a few of them.

The PMC Bank Account Holders Forum Coordinator Dipika Sahani wrote “This is our plight that even after the final scheme, it is detrimental to the interest of retail depositors as well as institutional and long-term depositors. It is totally against the interest of shareholders as it has wiped out the whole share capital. The entire scheme benefits the SFB as they not only got a license but all the PMC Bank assets in charity”, she added.

Another member of the PMC Bank Account Holders Forum Manjula Kotian wrote, ” After hearing the news of the PMC amalgamation, two depositors have already passed away. Many people are going through depression, everyone is in confusion and tensed as to where to go, whom should we approach now as we have already knocked the doors of all the officials”.

“We had already approached Bharat Pe, RBI Sentrum that this decision will not be accepted, this decision is not in our favor. We do not understand how we should react to this, we do not have any trust left in this government, even after Modi knew all the situation and crisis, he has kept his eyes closed. Shame on this Government”, Kotian’s message reads.

Reacting to this, a social media user and PMC Bank depositor wrote, This is an unfair scheme for the PMC Bank depositors. No interest for 5 years and it is shocking indeed how the corrupt system has manipulated things. We are disappointed and disheartened that none of our suggestions was incorporated into the draft “.

Meanwhile, helping the depositors of PMC Bank, Sahakar Bharati has entered the picture and decided to petition the Supreme Court against the amalgamation scheme of PMC Bank.

The Depositors have also got support from NAFCUB which has vowed to continue the fight for justice in favour of PMC Bank depositors.

Shame on RBI for not justifying with the facts, why share holders not considered, what benefits did shareholders reaped when shared not listed, Fixed deposits under LTD were issued what was LTD no depositors knew & their deposits too not considered, more assets were siezed then why not auctioned & paid to shareholders & Ltd fixed depositors, why no actions when scam was brought to notices of RBI in 2011, no grieviences heard, who’s being favoured at the loss of PMC Bank depositors. Who digested shareholders & LTD fixed deposits money?

Amalgamation plan prepared by RBI and approved without any changes is indication that ,we as RBI & Govt care dam about your suggestion and objections.

We also do not care about Sahakar Bharti or NAFCUB.

This amalgation plan is not only death warrant for PMCB but all Urban cooperative banks.

Now every citizen must think before putting money in bank especially co-operative banks as they have no future.

It appers that Govt and RBI do not want to protect depositors above Rs 5.00 L in co-operative banks. They have also shown their incompetence & unaccoutability towards depositors of co-operative banks.

Making co-operative ministry is eye wash, it will not able to protect depositors but will be used for political game and vote bank politics.

It is shame on RBI & Govt that inspite of death of 250 depositors ,they want to do fraud in bank & kill inocent depositors because they have deposited money in co-operative bank.

Amalgamation plan prepared by RBI and approved without any changes is indication that ,we as RBI & Govt care dam about your suggestion and objections.

They have also not cared about Sahakar Bharti or NAFCUB.

This amalgation plan is not only death warrant for PMCB but all Urban cooperative banks.

Now every citizen must think before putting money in bank especially co-operative banks

It appers that Govt and RBI do not want to protect depositors above Rs 5.00 L in co-operative banks. They have also shown their incompetence & unaccoutability towards depositors of co-operative banks.

It is shame on RBI & Govt that inspite of death of 250 depositors , want frauds to continue in bank & kill inocent depositors because they have deposited money in co-operative bank.

With Govt’s approval of RBI’s Amalgamation Proposal for takeover of PMC Bank by the newly formed Unity SFB, PMC Bank’s long suffering Depositors have lost all hopes of survival. Prima facie, it seems to be a case of collusion between Govt & RBI to cover-up the misdemeanours of some high level corrupt officials in RBI who were instrumental in the downfall of PMCB. In this murky mix there are of course several ubiquitous politicians belonging to various parties who enjoyed HDIL’s patronage. These RBI officials collaborated with HDIL and deliberately looked the other way despite a whistleblower complaint in 2011. Now many have been exonerated, many rewarded, the main perpetrators will be eventually set free. Unity SFB can scarcely believe their good fortune at the munificence heaped on them by RBI – all at the cost of the innocent Depositor victims, who have been swindled by HDIL first, then by RBI, later disenfranchised by Govt and now, discarded penniless, to be at the mercy of an unknown, unproved entity who has been gifted the lions share of the spoils. If this were a fictional account people would find it unbelievable, that in a modern, enlightened era there could be such villainy, victimisation and gross injustice. But as they say, truth is stranger than fiction. Judiciary won’t touch the case, Media is preoccupied with slavishly cavorting with the ruling party, investigative agencies are primed to act only against protestors, people are deep in the throes of blindly hero-worshipping their exalted leaders, unable to distinguish even between right and wrong. Winston Churchill may have been a despicable figure as far as Indians are concerned but when told of India’s impending independence, he may have been right when he uttered those prophetic words, exclaiming ‘Don’t hand over that country’s reins to those charlatans”

No fresh capital for any of the co.operative banks from the public from hereon

RBI acknowledged but ignored whistleblower report of 2011. Shows RBI was aware and most likely complicit in this fraud. It’s own auditor LM Kamble took a plumb position in PMC bank after retirement without following mandatory guidelines and rbi pretends it wasn’t aware what’s happening. Now RBI commits crime all over again by handing over everything to Unity on a platter, even now serious governance issues of Centrum-Bharat Pe founders are available in public domain. Who is RBI serving? Depositors or Fraudsters? Is this how GOI allows RBI to abuse powers? Why aren’t RBI auditors jailed for life? Since RBI is at fault, why aren’t their reserves and investor protection fund used to make good the losses of PMC depositors? Why no interest from day 1 after amalgamation at current interest rates of Unity SFB? So many whys and all against the common depositors proves RBI is not a regulator but is working only in the interest of fraudsters and future fraudsters. Is India a democracy that will ensure timely justice to PMC depositors? Is RBI bigger than India and Indians? Dismantle RBI completely if it cannot fulfill its objectives of regulatory oversight, lender of last resort, audit, etc. Take away all powers related to these roles from the RBI. And use RBI reserves to pay depositors affected by fraud.

PMCB have liquedity of Rs 3075 cr, Rs 800 cr assets, good loan of 1455 cr, recovery agsist HDIL Rs 1500 cr.UNITY bank only wanted to give Rs 2744 cr over perod of 10 years to even senor citizen depositor, inspite of above financial status. In other word UNITU want to use Liquedity of Rs 30075 cr and psyback Rs 2744 cr over 10 years. to PMCB depositors

It is shamefull decision of RBI & GOVT

Depositors are being penalised for investing in fixed deposits with PMC bank on the basis of rating given by RBI.

Please let us know what action RBI has taken against it’s officials / auditors, who have ignored the whistleblower and given highest investment rating to PMC.

Why this amalgamation process is not focusing on this issue?

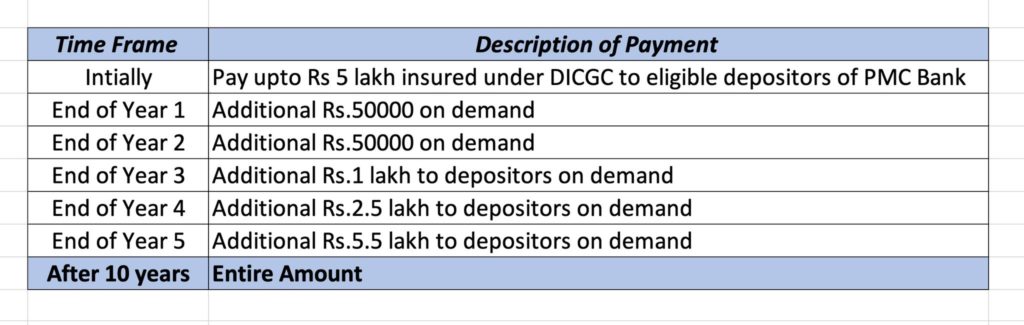

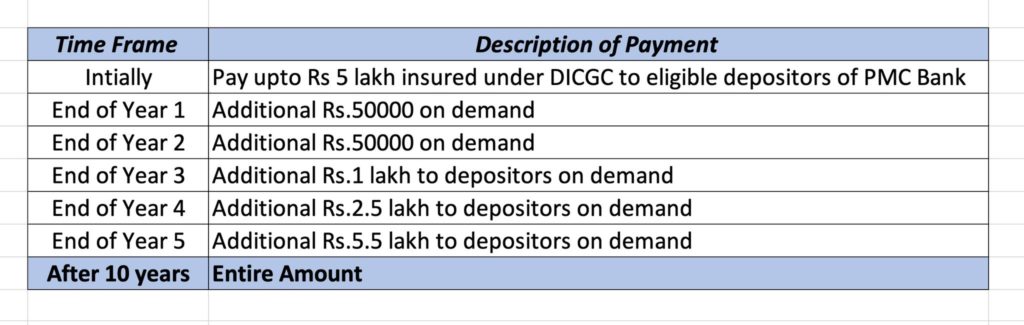

Further, DICGC is funding initial Rs.5 lacs per customer.

No interest will be given w.e.f.31/03/21 on deposits.

Then why amalgamation is required? Only to handover all assets of e-PMC to Unity SFB.

RBI, through its administrator, would have sold all the PMC assets and HDIL assets and would have distributed the amount to depositors/stake holders in % terms.

Further, what is the guarantee that Unity SFB will run for further 5-10 years. Whether RBI is taking the guarantee for refund of deposits if Unity SFB fails to do so.

Depositors are being penalised for investing in fixed deposits with PMC bank on the basis of rating given by RBI. Please let us know what action RBI has taken against it’s officials / auditors, who have ignored the whistleblower and given highest investment rating to PMC. Why this amalgamation process is not focusing on this issue? Further, DICGC is funding initial Rs.5 lacs per customer. No interest will be given w.e.f.31/03/21 on deposits. Then why amalgamation is required? Only to handover all assets of e-PMC to Unity SFB. RBI, through its administrator, would have sold all the PMC assets and HDIL assets and would have distributed the amount to depositors/stake holders in % terms. Further, what is the guarantee that Unity SFB will run for further 5-10 years. Whether RBI is taking the guarantee for refund of deposits if Unity SFB fails to do so.

This govt ….is not run by the people ….for the people….but for the pm…his freinds ..his allies ….when history will be written….the caption will be NERO part 2

Middle class has zero power to shake the government ,to wake up and address their problems. Either you have to be too poor,for freebies offered by politicians,from taxes collected from people,to their own benefit.or you have to be rich,to get job done,on your favour..

Sorry middle class people..you will be remembered on on voting day….

Goes to show that RBI does not care for depositors and that having RBI audits for any bank is just an eyewash. Also shows that govt only cares to infuse capital to banks where only Central govt has control. Disastrous move by the so called keepers of the system, to shake the co-op banks. Shows petty politics and blatant corruption wins over the public interest anytime. Worst is zero concern for senior citizens who have lifetime savings stuck for a decade and they mock saying 96% depositors will benefit with DICGC; better to auction off and give percentage wise share to all depositors.

It’s bad! The PM &The Finance Minister Have no sympthy for the common people .

Release our own money immediately we are not beggars