The Reserve Bank of India cancelled the license of Mumbai based City Cooperative Bank on Wednesday, dashing the hopes of depositors about getting its merger with Cosmos Bank. Last week, the RBI had cancelled the banking license for Purvanchal Co-operative Bank Ltd., located in Ghazipur, Uttar Pradesh.

In case of City Cooperative Bank, it bears recalling that one of the largest urban cooperative banks of India-Cosmos Cooperative Bank had submitted revised amalgamation cum merger proposal to RBI on 5th October 2023 but to no avail.

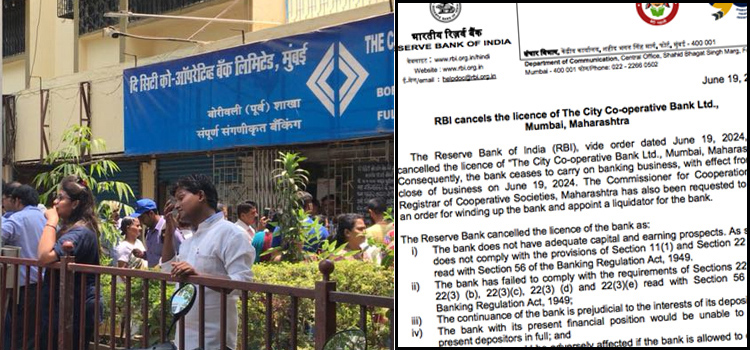

Issuing a press release in this connection, RBI said, “the bank (City Cooperative Bank) ceases to carry on banking business, with effect from the close of business on June 19, 2024. The Commissioner for Cooperation and Registrar of Cooperative Societies, Maharashtra has also been requested to issue an order for winding up the bank and appoint a liquidator for the bank”, the release said.

The Reserve Bank cancelled the licence of the bank because the bank does not have adequate capital and earning prospects. As such, it does not comply with the provisions of Section 11(1) and Section 22 (3) (d) read with Section 56 of the Banking Regulation Act, 1949.

Besides, the bank has failed to comply with the requirements of Sections 22(3) (a), 22(3) (b), 22(3)(c), 22(3) (d) and 22(3)(e) read with Section 56 of the Banking Regulation Act, 1949.

The RBI said, “the continuance of the bank is prejudicial to the interests of its depositors and the bank with its present financial position would be unable to pay its present depositors in full; and public interest would be adversely affected if the bank is allowed to carry on its banking business any further”, the apex bank noted.

According to the financial figures coming to the Indian Cooperative desk, the depositors have withdrawn to the extent of Rs.103.96 crores from their accounts on Hardship Grounds from the date of All Inclusive Direction (AID) i.e. 18th April 2018 up to 30th September 2023.

The bank has recovered Rs 117.59 crores from the defaulters of loan repayment from April 2018 to September 2023. The bank has a network of 10 branches in different parts of Mumbai.

As per the data submitted by the City Cooperative Bank, about 87% of the depositors are entitled to receive the full amount of their deposits from DICGC.

As on June 14, 2024, DICGC has already paid Rs 230.99 crore of the total insured deposits under the provisions of Section 18A of the DICGC Act, 1961 based on the willingness received from the concerned depositors of the bank.

Readers would recall that when the directions were issued on the bank on 17th April 2018, the bank Chairman and former MP from Amravati Anandrao Adsul hogged the media headlines for his alleged involvement in misappropriation of the bank’s depositors’ funds to the tune of Rs 900 crore.