The Reserve Bank of India cancelled the license of Mumbai based City Cooperative Bank on Wednesday, dashing the hopes of depositors about getting its merger with Cosmos Bank. Last week, the RBI had cancelled the banking license for Purvanchal Co-operative Bank Ltd., located in Ghazipur, Uttar Pradesh.

In case of City Cooperative Bank, it bears recalling that one of the largest urban cooperative banks of India-Cosmos Cooperative Bank had submitted revised amalgamation cum merger proposal to RBI on 5th October 2023 but to no avail.

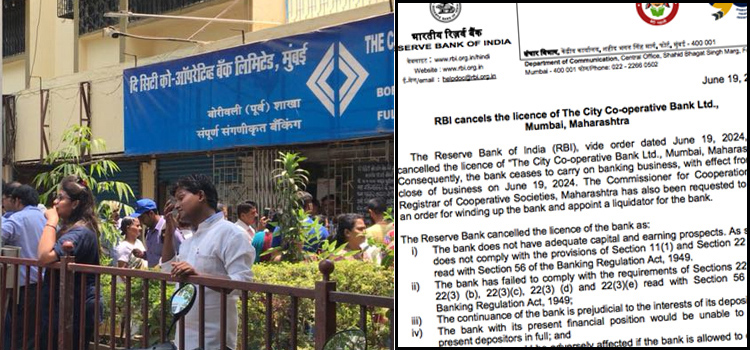

Issuing a press release in this connection, RBI said, “the bank (City Cooperative Bank) ceases to carry on banking business, with effect from the close of business on June 19, 2024. The Commissioner for Cooperation and Registrar of Cooperative Societies, Maharashtra has also been requested to issue an order for winding up the bank and appoint a liquidator for the bank”, the release said.

The Reserve Bank cancelled the licence of the bank because the bank does not have adequate capital and earning prospects. As such, it does not comply with the provisions of Section 11(1) and Section 22 (3) (d) read with Section 56 of the Banking Regulation Act, 1949.

Besides, the bank has failed to comply with the requirements of Sections 22(3) (a), 22(3) (b), 22(3)(c), 22(3) (d) and 22(3)(e) read with Section 56 of the Banking Regulation Act, 1949.

The RBI said, “the continuance of the bank is prejudicial to the interests of its depositors and the bank with its present financial position would be unable to pay its present depositors in full; and public interest would be adversely affected if the bank is allowed to carry on its banking business any further”, the apex bank noted.

According to the financial figures coming to the Indian Cooperative desk, the depositors have withdrawn to the extent of Rs.103.96 crores from their accounts on Hardship Grounds from the date of All Inclusive Direction (AID) i.e. 18th April 2018 up to 30th September 2023.

The bank has recovered Rs 117.59 crores from the defaulters of loan repayment from April 2018 to September 2023. The bank has a network of 10 branches in different parts of Mumbai.

As per the data submitted by the City Cooperative Bank, about 87% of the depositors are entitled to receive the full amount of their deposits from DICGC.

As on June 14, 2024, DICGC has already paid Rs 230.99 crore of the total insured deposits under the provisions of Section 18A of the DICGC Act, 1961 based on the willingness received from the concerned depositors of the bank.

Readers would recall that when the directions were issued on the bank on 17th April 2018, the bank Chairman and former MP from Amravati Anandrao Adsul hogged the media headlines for his alleged involvement in misappropriation of the bank’s depositors’ funds to the tune of Rs 900 crore.

This is absolute high headedness on part of RBI. They are destructor of depoits than protectors. By refusing merger with Cosmos Bank they have infact denied depositors of getting back atleast 65 percent of deposits on Day 1 of merger. Where is logic?

Could not they have applied PMC and Yes bank logic to us depositors of City Coop Bsnk and paid us in 10 yrs which would have instituted faith in us on RBI as our protectors.

RBI is misusing its power of position and is biased which is proved when they bailed out PMC bcoz it was their mistake and 350 cr of RBI empl deposits were stuck there.n hence the help.

Can courts of India Union take up this case suo moto n save their bretheren for we depositors do not have money to fight and that is advantage being taken by reckless RBI.

They have failed in their basic Audit responsibility before 2018 in City Coop Bank case and penalizing haplessd depositors like us.

Can our FM and PM aswer please and save us by prevailing on RBI top down.

Cosmos bank has already conducted their audit hence they found it fit to takeover. Inspite of their willingness RBI has no granted them permission to do so. This is impartial on their part. Most of the amount due had been recovered by City coop bank. The bank has also around 10 branches which property is worth crores of rupees. Most of the depositors are retired couples who had invested their hard earned money in the bank. The bank was operating very well. We fail to understand how it incurred losses. Also why are the depositors to be put into hardship when the directors and the management of the City coop bank have given loan which were not recoverable. Did we as depositors give permission to the committee. What happens to the people responsible. Why can’t they ensure depositors hard earned money is returned. The state and central government should look into this and handover the inquiry to a central agency so that facts come out in the open and we the ordinary account holders are returned their hard earned money. I appeal to all depositors to come forward in large numbers and protest against the rule out forth by RBI.

I ask RBI to take some serious of this issue and help the depositors of getting back there hard earned money

I appeal to RBI to take serious action against the bank management board and its directors and punish them. Also see that every depositors hard earned money is to be given back to them by selling banks property. Total responsibility lies with RBI being the monitoring bank. Please take back the cancellation of licence and do something for the merger of city coop bank. Sincere prayer from 91 year old depositor who deposited more than 85 lakhs. This was my entire retire fund amount.

Why is RBI acting so immature towards the public’s money. It’s not an gift, it’s their life long hard struggle of the depositors money n because of someone’s fault you are making the public bear their penalty, that’s not right RBI, Inspite of Cosmos Bank interest in City Co-op Bank .

RBI should be a means where public can rely that they will do their best for public’s interest.

Request RBI to seriously look into this unfortunate condition and help all depositors to get their hard earned money. Please 🙏. Thank you.

RBI, City Co Operative bank management, Anand Adsul & Family and his political party Shivsena has all let down 90000 poor investors of Mumbai. If this bank goes bankrupt and depositors’ money siphoned then no citizen will believe the RBI and the co-operative sector.

Mr. Modi and other such tall leaders should listen to the pain of common people and help to return the money.

I appeal to all 90000 families to stand behind only the political party which helps us get our money back in upcoming Maharashtra Vidhan Sabha elections or the BMC elections. Otherwise, just use NOTA and also encourage close family members, friends and neighbors to do the same.

Jai Hind, Jai Shri Ram

To Hon. Finance Ministry & RBI ‘s Governor,

We the CCB members Regret & Protest the decision of Canceling the Business License of CCB.

The RBI should have been taken strict Action against CCB’s Board of Directors & Management instead of putting the Innocent Senior Citizens & Deposit Holders in trouble whose Hard Earn Money is Blocked in CCB. It was kept with good Intentions with CCB for Self’s Future Survival & to fulfill Family’s Needed Requirement for Survival.

When Misuse of People’s money & High NPA was noticed by RBI, why strict action was not taken long back against Irresponsible Board of Directors & Management of CCB ??

We once again request Hon. Finance Ministry & RBI’s Governor to Revert the decision of Canceling the CCB’s Business License & to save Innocent Senior Citizens & Helpless Deposit Holders.

Thanking you with High Refards,

🙏🙏

RBI is working as per its wishes and whims. It allowed PMC bank to be taken over by Unity Small finance bank within no time and without any hesitstion. The lobby of PMC bank depositors was very stronge and having political connections. The RBI employees’ Credit Society also had an account with PMC and hence RBI took no time to take PMC out of troubled water. I also do not understand how the closure of the bank will help to protect the interests of the depositors. Will RBI explain this. We also do not know what action RBI or Govt. Agencies have taken against the Chairman, Directors, officers responsible for this scam and ultimately duping the depositors on whose money bank was doing business for so many years. All the culprits should be punished and the Bank be allowed to resume its business.

We the City Co-op Banks Share Holders /Deposit Holder / Customers Regret the RBI’s order on Cancelation of CCBs Business License. The Finance Ministry & RBI should have been thought twice of the Innocent Senior Citizens & Deposit Holders. Considering the situation of NPA who is resposible for this should have be questioned & accordingly the Strict Action should have been taken on Resposible Board of Directors & Management of CCB instead of putting Innocent Customers in the Worst situation . Hard Earn Money was kept in CCB with good intentions for their future need & requirements for betterment & not to Misuse of CCBs Directors/ Management.

We all Customers of CCB Request Hon. Finance Ministry & RBI to come forward to Punish the Culprits & save Innocent Customers by Reversing the Sad/ Painful Decision on Cancelation of CCBs Business License.

How the RBI is going to protect the interests of the Depositors if the City Coop bank by cancelling its licences and stopping it to do any banking activities. Will RBI explain this to depisitors and Public as a whole? Will FM, Home Minister or PM look into this matter and help the depositors to get their hard earn money ?

To the Finance Ministry & RBI Governer,

We the Senior Citizens & Depositers of City Co operative Bank Regret of Canceling the Business License since the Bank’s this condition became because of Bank’s Mismanagement & Board of Director’s for which Innocent Senior Citizens & Depositors are not responsible.

When since 2016 onwards RBI found CCB’s Annual Balancesheet is not Healthy & NOA is High why they didn’t take strict Action against Bank’s Board of Directors ? Why they didn’t controlled the Bank’s Business going from bad to worst ?

Innocent Senior Citizens & Depositors invested their Hard Earned Money in Bank’s Business to get the return for their future survival by keeping faith in Bank Business.

It’s unfortunate of Innocent Depisiters by keeping Faith in CCB Management aswell RBI who are the Higest Authorities to controlled the Co opertaive bankvthey have to take the great loss of their own Money.

We once again request to Hon. Finance Ministry & RBI to Revert the worst decision of Canceling the sCCB’s Business License & to punish the Bank’s Culprit Board & Management by merging the Bank with other Healthy Co operative Bank like “Cosmos Bank” who were ready to Merge with CCB.

On Humanity back ground save Innocent by punishing the Culprits by keeping positive approach by Finance Ministry & RBI Governer.

Regards & Thanking by keeping positive Action.

We the Senior Citizens & FD Holders Regret & protest against the Decision of Canceling the Business License of “City Co-operative Bank” by RBI. When RBI is appointed as the Head Controller for all Nationalised & Co- Operative Bank sector for smooth functioning of Banking Sector aswell safty of Depositors Investment by making appropriate Rules by Finance Ministry, why RBI didn’t controlled & took Strict Action against the Board of Directors / Management of CCB after observing the Imbalance transactions & Unhealthy Balancesheet of 2016/17 who had brought the worst situation on Innocent Senior Citizens/ FD Holders who had invested their entire life’s Hard Earnings which they saved for their future Survival. We would like to know Who is responsible for this worst Condition.

*Once again we all Request Finance Ministry & RBI Governor to Study on Banks previous unhealthy business & to Revert the Decision of Canceling the Business Licence of CCB to save Innocent Senior Citizens & Depositers.

Expecting the Positive Action in Right Spirit.

Regards & Thanks

I had a deposit of Rs.1.87 lacs with CCB, but still today I had not received a single paise for the said deposit which is in my savings account. RBI has to look into this and return us the said amt as this is hard earned money of my father where it was joint account, Now RBI has cancelled the license. I had approach to them on 25.06.2024 but replied received that the accounts as being freezed and RBI will look after that money which is still pending with CCB,

I request the RBI to get it cleared as soon as possible