In a significant development, the Reserve Bank of India (RBI) has issued directions under Section 35A, read with Section 56 of the Banking Regulation Act, 1949 (as applicable to cooperative societies), to the Mumbai-based multi-state scheduled bank—New India Cooperative Bank—on Thursday, for a period of six months.

As per these directions, the bank shall not, without prior written approval from the RBI, grant or renew any loans and advances, make any investments, incur any liability (including borrowing funds and accepting fresh deposits), disburse or agree to disburse any payment (whether in discharge of its liabilities and obligations or otherwise), enter into any compromise or arrangement, or sell, transfer, or otherwise dispose of any of its properties or assets—except as specified in the RBI directive dated February 13, 2025.

A copy of this directive has been displayed on the bank’s website and premises for public reference.

Considering the bank’s current liquidity position, it has been directed not to allow any withdrawals from savings, current, or other accounts. However, depositors are permitted to set off their loans against deposits, subject to conditions outlined in the RBI directive. The bank is allowed to incur expenses on essential items such as employee salaries, rent, and electricity bills, as specified in the directions.

These restrictions have been imposed due to supervisory concerns arising from recent material developments in the bank, with the primary objective of safeguarding depositors’ interests.

Eligible depositors will be entitled to receive deposit insurance claims of up to Rs 5,00,000 under the provisions of the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, 1961, upon submission of willingness and due verification. Depositors seeking further information may contact bank officials or visit the DICGC website at www.dicgc.org.in.

It is important to note that the issuance of these directions does not imply the cancellation of the bank’s license. The bank will continue its operations under the imposed restrictions until its financial position improves. The RBI will continue to monitor the situation and may modify these directions as necessary in the interest of depositors.

These directions will remain in force for six months, effective from the close of business on February 13, 2025, and are subject to review.

As per the bank’s financial report for the fiscal year 2023-24, it recorded a net loss of Rs 30.74 crore in 2022-23 and Rs 22.77 crore in 2023-24, declaring no dividend for FY 2023-24. As of March 31, 2024, the bank’s deposits stood at Rs 2,436 crore, while advances amounted to Rs 1,174 crore, bringing its total business to Rs 3,610 crore.

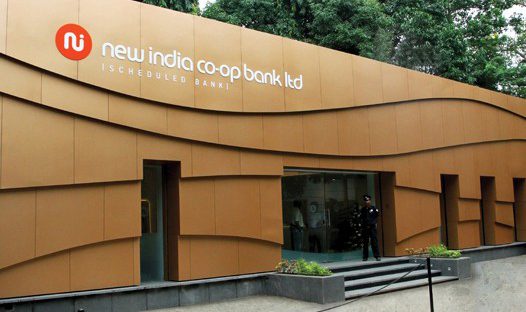

The bank operates 28 branches, primarily located in Maharashtra and Gujarat, with a major presence in Mumbai.