The RBI has given a relief to the UCB sector by extending the deadline of meeting Priority Sector Lending targets by two years from March 31, 2024 to March 31, 2026. The regulator had issued a Master Direction which earlier gave a deadline of five years to the UCBs. Now it has become seven years.

“In order to address implementational challenges faced by the UCBs and to make the transition non-disruptive, it has been decided to extend the glide path for these PSL targets by an additional period of two years, ” says RBI.

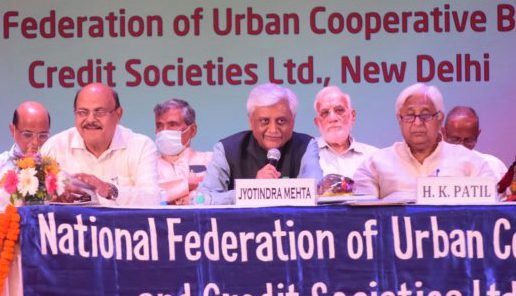

Welcoming the move, NAFCUB President Jyotindra Mehta said that though the extension of the deadline would give us relief, the real issue of restructuring the Target Areas and reduction from 60% to 40% remain unanswered.

Mehta repeated his demand and sought parity with Commercial banks. “We demand modifications in achieving the target for UCBs under PSL from existing 60 percent to 40 percent on the lines of Commercial Banks”, he said to the Indian Cooperative.

Talking to the Indian Cooperative, Maharashtra UCBs’ Federation Chairman, Ajay Barmecha said, “Three notifications released by RBI on Priority Sector Lending, technical write-offs of NPAs and branch expansions are welcome moves. The RBI has started addressing the issues of urban cooperative banking sector, which is commendable”.

Repeating what Mehta said, Barmecha stated “but our demand for PSL target to become 40 percent has yet not been met. It is still 60 percent, though earlier it was 75 percent. We are hopeful RBI would consider our demand of making it 40 percent sooner than later”, he added.

The issue is a major challenge especially for those UCBs that fall under Tier-2 and Tier 3 categories. UCBs are hard-pressed on the issue of investment in infrastructure bonds of SIDBI. According to the figures received at the desk of the Indian Cooperative, “In 2020-21, twenty-two Maharashtra UCBs received the notice from RBI. The shortfall amount in the said year is more than Rs 2000 crore whereas in 2021-22, about 23 Maharashtra based UCBs didn’t not meet the PSL target. The shortfall amount in this year is around Rs 2500 crore.

One of the cooperative banking experts said, “Blocking funds at lowest rates would have severe consequences and effects on the availability of funds for lending, NIM and profitability of banks”.

Priority Sector Lending (PSL) lays down targets to give loans and advances to weaker sections. UCBs were also advised to contribute to Rural Infrastructure Development Fund (RIDF) established with NABARD and other Funds with NABARD / NHB / SIDBI / MUDRA Ltd.,

“In view of the implementation challenges observed, it has been decided that UCBs would not be required to contribute to RIDF or other eligible funds for shortfall in PSL target/ sub-targets during Financial Year (FY) 2020-21 and FY 2021-22”, says the RBI.

Secondly, UCBs shall contribute to RIDF and other eligible funds against their shortfall in PSL target/ sub-targets vis-à-vis the prescribed targets with effect from March31, 2023, it added. RBI also says that those UCBs which have met the PSL target will be given Incentives to be announced separately.

Many UCBs do not have sufficient liquidity to invest such a huge fund in these infrastructure bonds of SIDBI. In order to meet this shortfall, UCBs will have to raise funds for investment with SIDBI by liquidating SLR securities i.e. Government securities as a distress sale at lower market values by incurring huge losses.