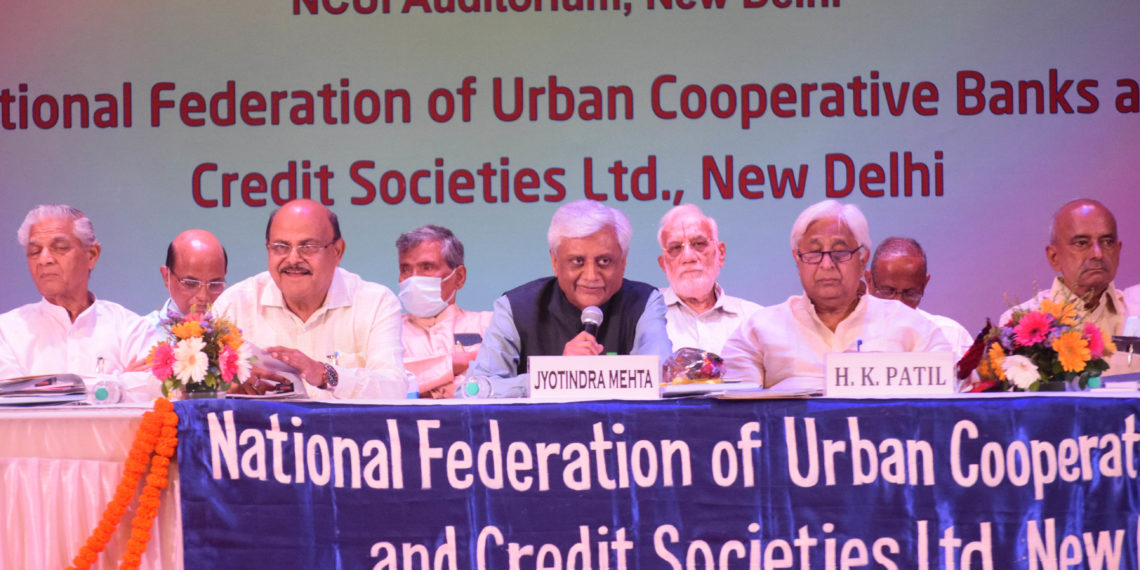

The 45th AGM of the apex body of UCBs and credit co-op in the country- NAFCUB, was held in the backdrop of sweeping powers accorded to the RBI to supervise them. Leaders after leaders expressed their apprehensions that little does RBI realize its interference can dent the cooperative character of UCBs.

Chairman Emeritus H K Patil declared that RBI has to know that we are social entities, far removed from the commercial ethos ruling Corporate banks. Patil, who hails from Karnataka has been fighting the RBI diktat since a long time. It is no coincidence that the Karnataka High Court recently stayed the BoM Circular issued by the RBI. Karnataka Chapter of Nafcub had filed the petition challenging the Circular.

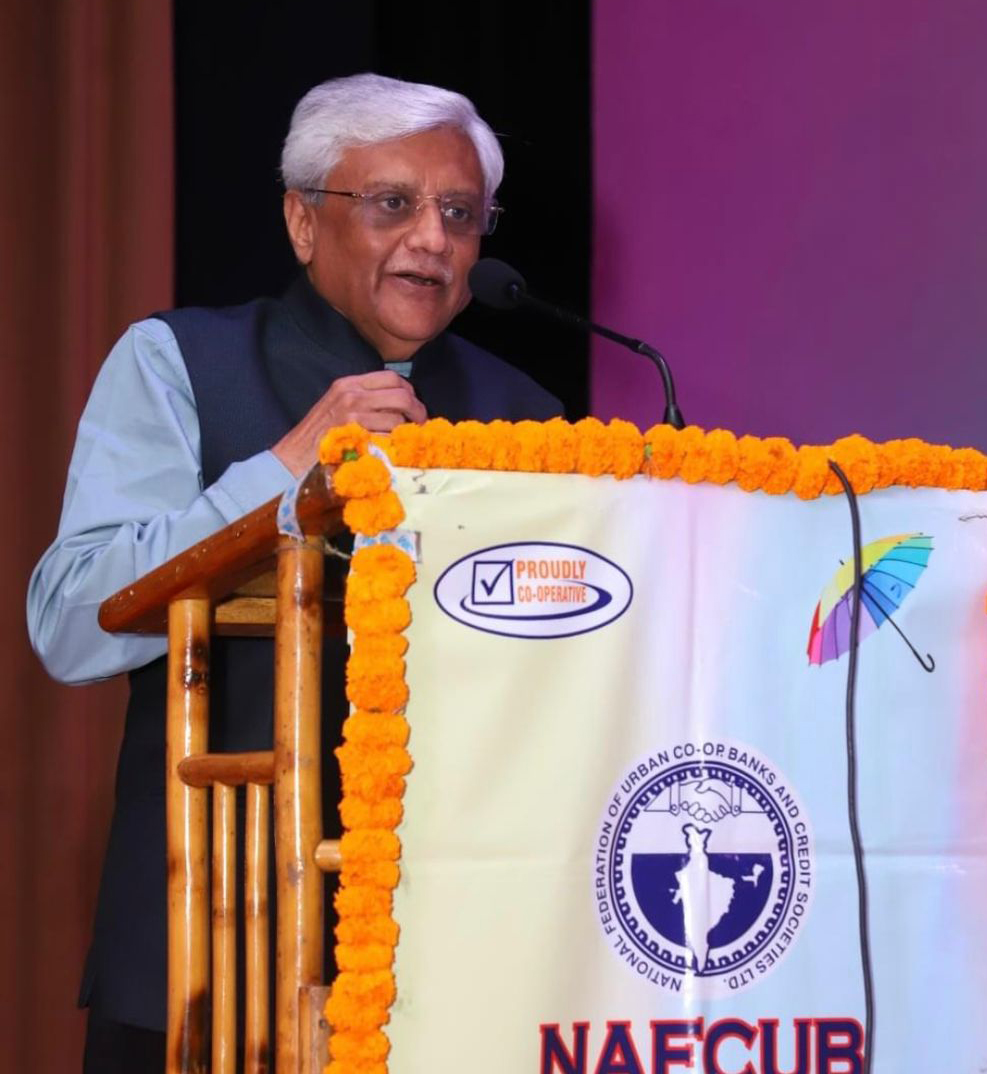

Echoing the sentiment, Nafcub President Jyotindra Mehta said the interference by RBI has increased after the passage of the amendment and we are afraid that one fine morning we will read in newspapers that small and unit banks are being merged or liquidated.

There were 15 litigations and all of them have got a stay from the court with the Madhya Pradesh High Court staying the entire Circular.

“I want to assure the Big Kanjivaram Co-op Bank, which is fighting the case that NAFCUB would lend it all support. We are with you”, said Mehta replying to the demand from a section of delegates that Nafcub should play a more active legal role in the matter.

Mehta also dwelt extensively on the Expert Committee report and mentioned his note of dissent, a development unheard of in RBI’s committee reports. “I am happy that the entire sector reacted on the issue and views came from all quarters”, said Mehta informing that the EC has accepted many of the sector’s points including that on BoM, Elevation to Scheduled Bank status, re-evaluating old buildings as capital, UCBs’ participation in govt schemes such as Mudra, etc, UCBs getting a part of govt business, award of a license to UCBs and many more.

Mehta’s note of dissent, among other things, talks of not encouraging conversion of UCBs into commercial

On the occasion, Mehta also talked of the importance of data and said as Advocacy Forum, Nafcub can achieve much more if it has a pool of reliable data. Exhorting members to send their data to Nafcub, Mehta recalled an ILO tweet that criticized Indian co-ops for having no reliable data.

Mehta also referred to the Umbrella Organization in the AGM and compared it to Rabobank underlining the power of collective strength. “Let come what comes, we have to remain united to exert influence on the system”, said Mehta. He also wanted a say of UCBs in various govt departments including finance.

“Total deposits of UCBs as of 31st March 2021 is Rs 5.16 crore, total advances are Rs 3.06 crore and gross NPAs have increased to 11.09 while net NPA is at a comfortable level of 4.4”, underlined Mehta.

H K Patil and many others also spoke on the occasion. Patil’s impressive speech and interesting reactions from the delegates on the occasion would be covered in these columns soon.