Mumbai based Model Cooperative Bank has performed well on all the financial parameters in the 2022-23 financial year. The bank achieved a business mix of Rs 1,769 crore and earned a net profit to the tune of Rs 8.21 crore as of 31st March 2023.

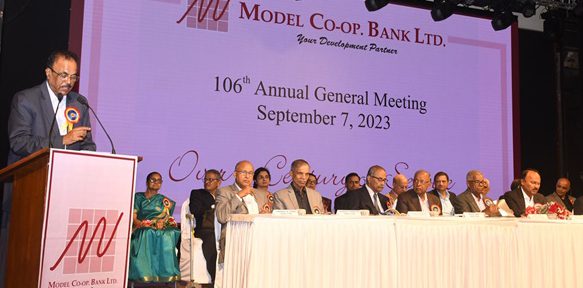

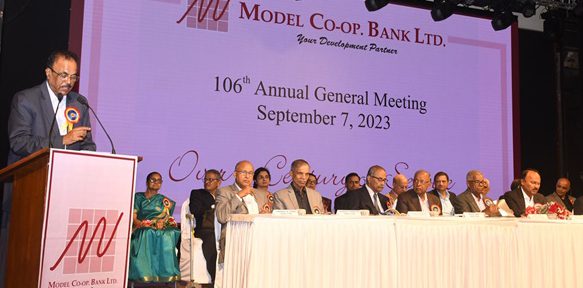

It was announced during the bank’s 106th Annual General Meeting held in Mumbai that the bank would give a 10 percent dividend to its shareholders for the 2022-23 FY.

During the meeting, the bank Chairman Albert W.D’souza in the presence of other members of the board of directors inaugurated QR Code scanner as well Platinum Rupay Debit Cards for the benefits of elite customers. Several other things are in the pipeline as a future IT initiative.

The deposits of the bank grew from Rs 1,122.14 crore (2021-22) to Rs 1,152.46 as on 31st March 2023 whereas advances increased from Rs 592.22 crore to Rs 617 crore.

Besides, the Capital Adequacy Ratio as on 31.03.2023 is 15.91% compared to 13.08% as on 31.03.2022. The Net Non Performing Assets (NPA) to Net Advances Ratio as on 31.03.2023 have decreased to 0.94% compared to 1.88% as on 31.03.2022.

The bank has a network of 25 branches and the area of operation covers Greater Mumbai, Thane, Palghar and Raigad district. The bank is equipped with all modern facilities.

The bank CEO Osden A.Fonseca presented the annual report before the members for approval.

However, our efforts to contact the bank chairman for his comment on the annual report were not successful.

William J Sequeira proposed a vote of thanks.