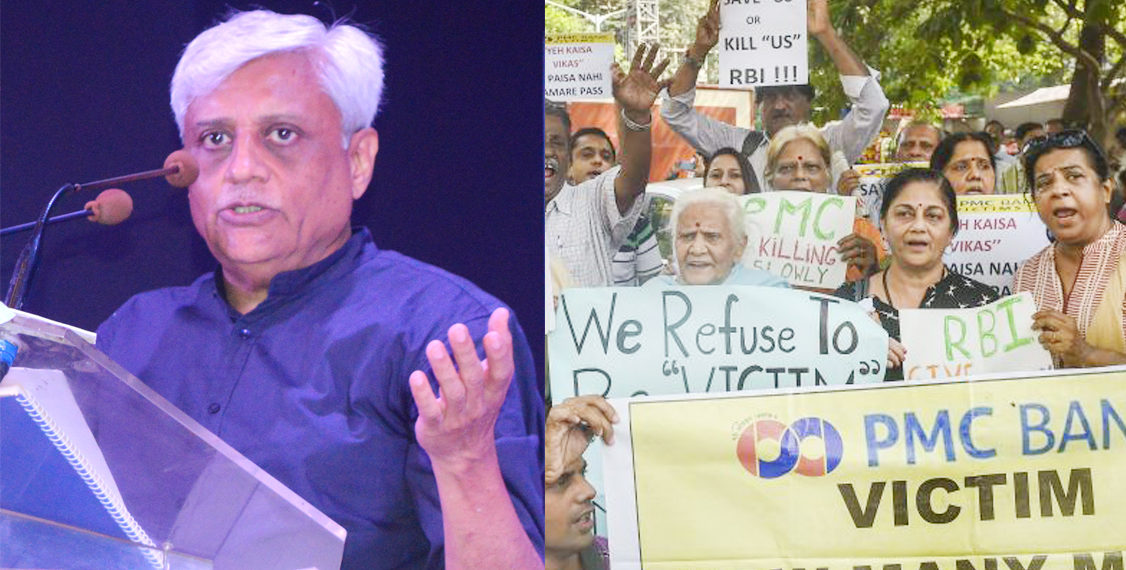

Nafucb President Jyotindra Mehta who doubles as the Patron of Sahakar Bharati has reacted to the passage of the Banking Regulation (Amendment) Bill, 2020 in a guarded manner.

Without commenting whether the amendment is good or bad for the sector Mehta said “Our first expectation is to see a quick resolution of PMC Bank since it was this bank on whose name the amendment was pushed through”, added Mehta.

Explaining further Mehta said that in his views RBI always had enough powers even before this act to intervene in the matter of PMC Bank. RBI had no such power in case of those UCBs which operated under state co-op act but for multi-state co-op banks such as PMC, it always had the power, summarised Nafcub president.

Referring to the latest press release from the RBI appointing a new Administrator in the PMC Bank, Mehta said the last paragraph is defensive and talks of pandemic rather than the lack of enough legal teeth to set right the PMC Bank crisis.

Plus, there is also a sense of fear among small urban co-op banks in the wake of the passage of this amendment, explained Nafcub president which represents close to 1500 banks. “They are scared that they would either be merged or would be wiped out after the new Bill gets operational”, said Mehta clarifying hastily that I do not say their fear is well-founded or not but I am only explaining what they are going through now.

“Now since RBI is power to supervise co-op banking RBI should ensure discontinuation of all the moves to privatise cooperative banks and should not undermine the continued existence of small urban banks through any process of compulsory consolidation. RBI should also ensure level playing field for cooperative banks with commercial banks,” underlined Mehta.

I still believe Umbrella Organization for UCBs is the one-stop solution for the urban cooperative banks as it would lend them real strength in terms of pooling together their resources, underlined Mehta.

UCBs have to come together to consolidate their business plans, technology and other things, stated Mehta. UCBs are likely to increasingly face competition from players such as Small Finance banks (SFBs), Payments Banks, NBFCs and Micro-Finance Institutions (MFIs). It is, therefore, necessary for them to adopt robust technology to enable them to provide banking services at lower costs and with adequate safeguards, he said.

The Reserve Bank is also taking proactive steps to assist these institutions to set up at national level Umbrella Organisation (UO) which is expected to provide liquidity and capital support to member co-operative banks, and will therefore contribute to the strength and vibrancy of the sector.