Amidst news of irregularities in one of the leading UCBs of Gujarat, Mehsana Urban Cooperative Bank, the Central Registrar of Cooperative Societies Vivek Aggarwal has appointed Vipal Ganda, Advocate as an Arbitrator to resolve the issues.

Arbitrator Vipal Ganda has been asked to submit his report to the office of the Central Registrar within 90 days. The cases, among others, relate to misappropriation of funds by the Chairman and some of the Directors of Mehsana Urban Cooperative Bank.

A slew of complaints was filed by a few shareholders led by one Kiritbhai Patel against the Bank citing hanky-panky deals and cases of irregularities. The complaints name UCB’s current Chairman Ganpatbhai Patel, CEO Vinod M Patel and some other directors for their involvement in misappropriation of funds.

In the beginning, the Central Registrar tried to solve the matter through several rounds of hearings from the two sides but in the end, he appointed an Arbitrator to arbitrate on the matter.

The issues include whether appointment of CEO, Vinod Patel after superannuation, is in violation of rules as laid down in the bye-laws of the bank, whether any loans have been extended which are violative of the provisions of section 29 and 43 of the MSCS Act, 2002 or any of the provision of MSCS Rules 2002 & the guidelines of RBI.

Some other issues pertain to if the directors who have been re-elected in the board including the Chairman of the bank mentioned in the RBI’s report dated 06.12.2018, were eligible to contest in the election held in September 2019 and whether the election process was in consonance with the provisions of MSCS Act, 2002 and rules made there under.

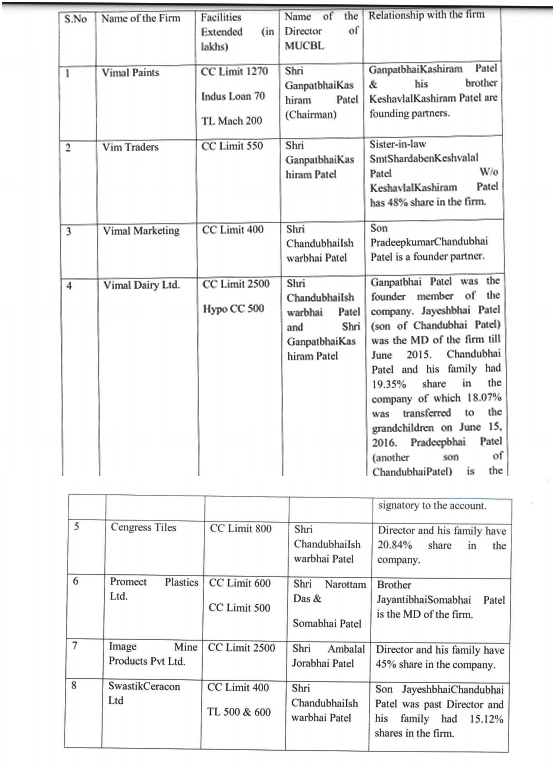

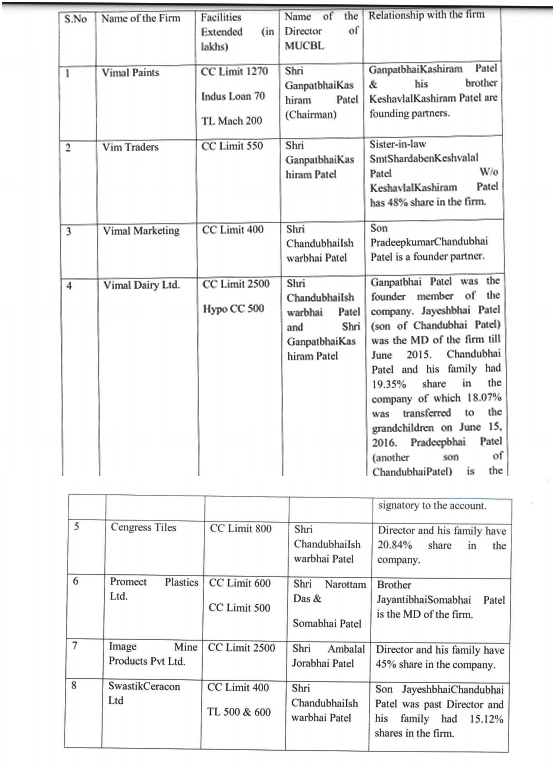

The Order related to the appointment of arbitrator was released last week. The Order also quotes RBI forwarded list of directors related accounts in Mehsana UCB wherein the bank has extended credit to the Chairman/Directors and their relatives.

The list includes the name of eight firms which are associated with the bank’s Chairman Ganpatbhai Patel, director Chandubhai Patel, Narottambhai Patel, Somabhai Patel and Ambalal Patel.

“They had got the cash credit limit extended from the bank which is against the RBI norms. They have neither paid the capital money back to the UCB nor paid the interest on them’ alleged shareholder Kiritbhai Patel to this correspondent on phone.

Readers would recall that the Reserve Bank of India (RBI) had order dated November 04, 2019, imposed monetary penalty of Rs 5 Crore on The Mehsana Urban Co-operative Bank Ltd., Mehsana, Gujarat (the bank) for contravention of the directions issued by RBI on ‘Loans and Advances to Directors, Relatives and Firms/Concerns in which they are Interested’, and non-compliance with the Master Directions on ‘Know Your Customer (KYC)’.

The list released by the RBI could be accessed here: