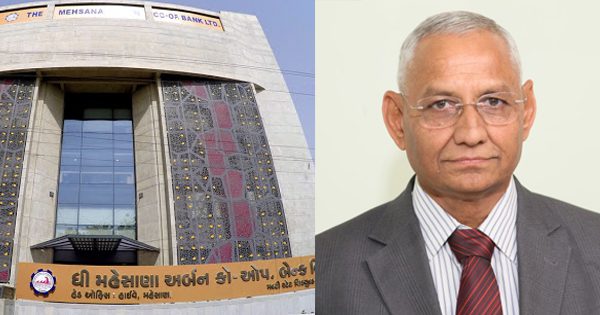

Gujarat based Mehsana Urban Cooperative Bank (Multi-State Scheduled Bank) crossed the business mix of more than Rs 13,000 crore and earned a profit of Rs 117 crore in the 2022-23 financial year. The bank earned the highest ever profit in its history.

The bank has performed well on all the financial parameters in the current fiscal. The business mix of the bank increased from Rs 12,370 (2021-22) to Rs 13,657 crore as of 31st March 2023.

The deposits of the bank increased from Rs 7,228 crore to Rs 8078 crore whereas advances rose from Rs 5142 crore to Rs 5579 crore in the 2022-23 FY. Besides, as of 31st March 2023, the share capital and working capital stood at Rs 375 crore and 9673 crores respectively.

Meanwhile, the bank announced its 40th Annual General Meeting on 26th May 2023 at Mehsana. This year the bank also proposed a 15th percent dividend for its shareholders.

The bank provides different types of facilities, which include ASBA Services, ATM, SMS Service, Demat Facilities, mobile banking, to its customers with a network of 58 branches.

The net and gross NPAs stood at 0.83 percent and 6.20 percent as of 31st March 2023 respectively. Provision required for NPA as on 31 March 2023 is of Rs 129.72 crore as per the RBI guidelines, against this the bank has made provision of Rs 302.41 crore, read bank’s annual report for the year 2022-23.

“During the year, the bank has re-valued its 17 branches, which comes to Rs 83.72 crore. As per the RBI guidelines, UCBs have to extend 60 percent advances of their adjusted net bank credit to priority sectors, 11.50% advance to weaker sections and 7.50 percent advance to micro enterprises. At the year ended on 31.03.2023, the final average priority advance stood at 73.92 percent”, the report added.

Readers would recall that last year, the Reserve Bank of India imposed a penalty of Rs 40 lakh on the Mehsana Urban Cooperative Bank, for non-compliance with various norms.