When the February Cabinet decision to amend the Banking Regulation Act to bring UCBs under RBI could not be passed in Parliament due to Covid, the Union Cabinet on Wednesday promulgated an Ordinance for the same.

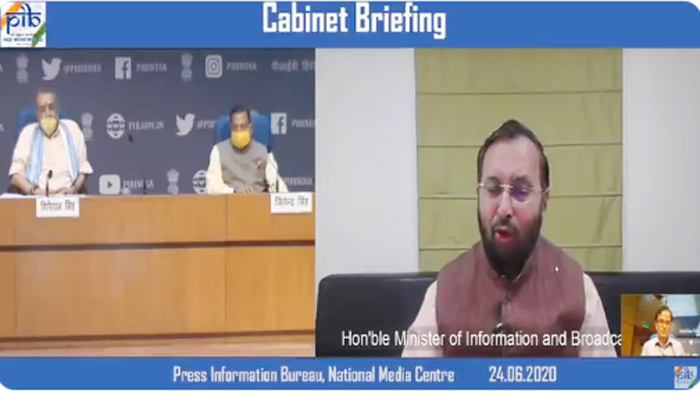

“The Union Cabinet meeting held on Wednesday decided to bring all UCBs under the Reserve Bank of India through an ordinance, announced by Union Information and Broadcasting Minister Prakash Javadekar during a virtual press meet.

The Union government will bring in an ordinance to put cooperative banks under the RBI supervision. The Union government has decided to bring 1,540 UCBs under the supervisory powers of the Reserve Bank of India.

Contrary to public opinion, co-operators connected with the sector are happy with the development. Many of them including Nafcub, Sahakar Bharati as well as Chairman of the largest UCB Saraswat Bank Gautam Thakur had earlier expressed support to the idea.

The decision to bring cooperative banks under RBI’s supervision will give an assurance to more than 8.6 crore depositors in these banks that their money amounting to Rs 4.84 lakh crore will stay safe,” said Union Minister Prakash Javadekar.

With immediate effect from the date of the President’s nod for the ordinance, the co-operative banks in the country will come under the RBI’s supervision.

During her Budget speech, Finance Minister Nirmala Sitharaman had mentioned that cooperative banks would be brought under the ambit of the RBI. However, the Banking Regulation (Amendment) Bill, 2020, could not be passed in the Budget session of the parliament, since the session had to be curtailed due to the COVID-19 pandemic.

The amendment would not do away with the role of Central Registrar, however. He would be responsible for their registration, etc.

Though there would not be any issues with the general recruitment process of co-op banks due to this amendment, the top management (CEO) would be selected by a Panel approved by the RBI. RBI also will have the right to recall a CEO.

Most importantly, the RBI would decide on the Panel of auditors for a UCB. Such panels would obviously be different for different categories of banks, depending on the size and business. “A panel of auditors suitable for a large UCB such as Saraswat Bank would not be useful for

the smaller UCBs”, clarified Marathe.