Considering the news that the amendment to the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, 1961 will be tabled in the upcoming monsoon session, Sahakar Bharati has called for raising deposit insurance limit for institutional investors to Rs 25 lakh.

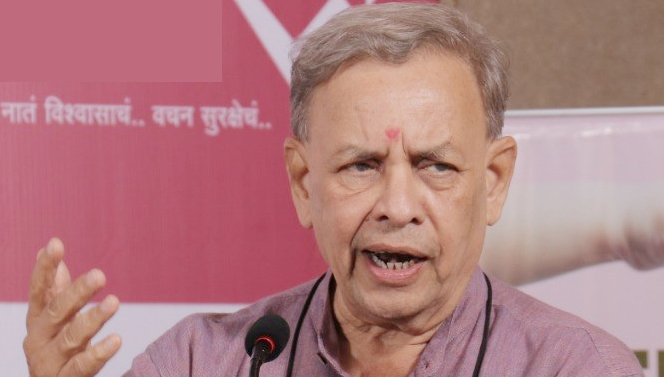

Talking to Indian Cooperative correspondent Sahakar Bharati ‘s one of the founder Chairmen and RBI central board director Satish Marathe said, “We had demanded a separate Deposit Insurance Limit for Institutional Depositors, Special Provision in the DICGC Act, 1961 to protect the interests of Depositors of fraud affected banks like PMC Bank Ltd, Pen Urban Co-op Bank Ltd, etc.

Firstly, the Deposit Insurance Limit for institutional investors has to be raised to Rs 25,00,000. Secondly, there should be a provision if a respective bank wants to give more protection to the depositor’s money beyond Rs 5 lakh”, he demands.

He further added that at present depositors of the fraud affected banks have to wait for long to get their money back. So, there should be a time bound access to funds. And in this context RBI should frame a strategy because the apex bank is the authority for revival merger, or cancelling the license of any of the banks”, said Marathe on the phone.

Considering the profile of the Indian Banking Sector, it is estimated that 75% of the banks (PSUs or Foreign Banks) are never likely to fail and hence, even if, the Deposit Insurance Limits are raised there is no case for enhancing the present Deposit Insurance Premium.

Finance Minister Nirmala Sitharaman in her Budget speech in February said the government had approved an increase in the Deposit Insurance cover from Rs 1 lakh to Rs 5 lakh for bank customers last year.

Media reports hints the government may bring in an amendment to the DICGC Act with a view to affording account holders a hassle-free access to funds to the extent of the deposit insurance cover.

The amendment to the (DICGC) Act, 1961 is an important announcement made by the Finance Minister. It is said the bill is likely to be tabled in the upcoming monsoon session of parliament.

DICGC, a wholly-owned subsidiary of the Reserve Bank of India, provides insurance cover on bank deposits.

The senior citizens of India have no option but to put in money in bank so that they can get interest and run home. It is most unfortunate that when such middle class depositors depositors large amount in co-operative bank they are not protected. PMCB is classic case where depositors have to do suicide or die.