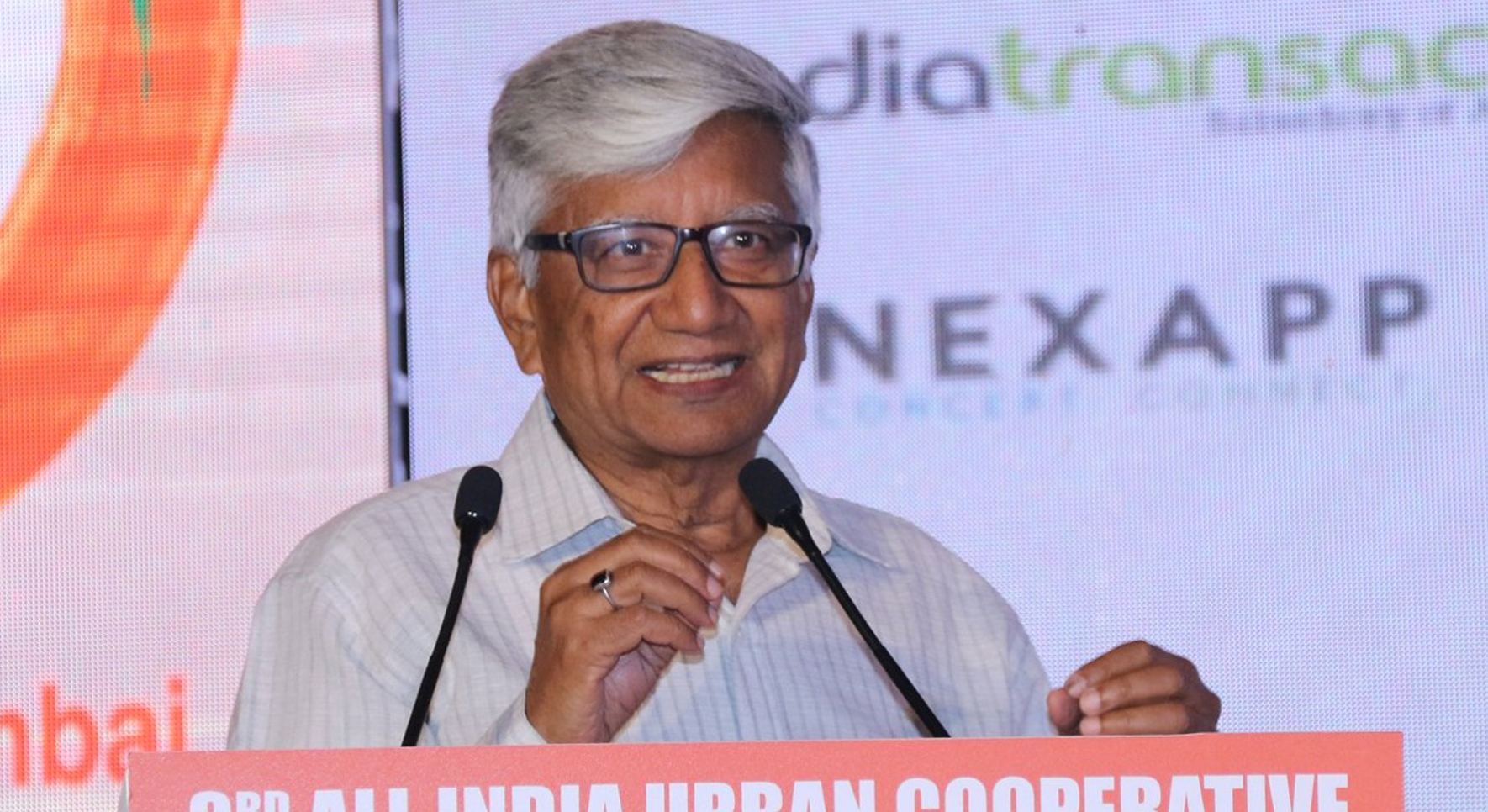

A retired Chief Executive of National Federation of Urban Cooperative Banks and Credit Societies (NAFCUB), D Krishna has penned a letter to Jayant Patil, Minister in the Government of Maharashtra. Since Krishna is an old hand known for his expertise in banking matters in the UCB sector, we deemed it fit to reproduce the same for readers’ benefit-Editor

Hon’ble Sh. Jayant Patil,

Sub: Proposal to save 3 lakh depositors of PMC Bank from losing their deposits

Sir, I introduce myself as the retired Chief Executive of National Federation of Urban Cooperative Banks and Credit Societies (NAFCUB). I have been associated with regulatory developments of urban cooperative banks for around two decades and I have also been in many committees/ working groups constituted by the RBI on urban cooperative banks during the period. I was also Liquidator of Apex Urban Cooperative Bank of Maharashtra and Goa for three years.

I am making some submissions to you after reading about the State Government’s intention of exploring avenues to help the depositors of PMC Bank by merging it with the Maharashtra State Cooperative Bank.

PMC Bank is a multistate urban bank and is under the Central Government. However, most of the depositors of the bank are from state of Maharashtra and therefore it makes eminent sense that the state government is seen to do what it can in helping the unfortunate depositors of the bank.

Sir, the failure of PMC Bank is not a case of just not another cooperative bank failing. It has already thrown up basic questions of far reaching nature which the RBI and Govt. of India have to find answers to give to public at large. Like, why cooperative bank depositors are left high and dry while those of public and private sector banks are well taken care of by RBI, why should DICGC have first charge over assets, leaving depositors to take left over, if any. Why enormous amounts of NPAs of large corporate are written off by PSU banks every year with the taxpayers meeting the cost, while cooperative banks are given no support although they cater to people of small means.

As far as the state government is concerned, you have rightly said that it will find ways to protect depositors’ interest. It is a historic fact the Congress and the NCP have an umbilical and grass roots relationship with cooperative banks in Maharashtra and it is in their nature to understand cooperatives.

Sir, coming to PMC Bank specifically, I have the following observations and suggestions to make:

1.If the Govt. of Maharashtra is serious about helping the depositors, please make sincere attempt to do so.

2.The MSCB cannot enrol individuals as members, therefore the members of PMC Bank cannot become members of MSC Bank. Since PMC Bank has negative networth, there is no value for its shares.

MSCB can take over assets and liabilities of PMC Bank.

3.Presently, as per reports, with Rs6500cr. as NPAs out of advances of Rs8500cr, the PMC Bank may be staring at accumulated loss of over Rs4500cr. In this position, MSCB cannot think of taking it over.

4.Two things have to happen,

- a) the DICGC should meet the liability of payment of insured deposits of say, Rs4500cr, which would fully pay around 80 percent of the depositors. Balance of depositors, numbering around 2.25lakhs, including institutional depositors will be having to take Rs7000cr (Rs11500cr-Rs7500cr.) If the PMC Bank is liquidated, all these depositors stand to lose their entire money.

As per present provisions of DICGC Act, the sale proceeds of the assets that are with the Bank, will first be used to repay the Rs4500cr. to DICGC and whatever is in excess of this amount, will be proportionally distributed among depositors and other unsecured creditors.

From the reports it is said that the ED has impounded assets worth Rs6500cr of the directors. If the disposal of

At this stage Govt of Maharshtra can propose takeover of the PMC Bank by MSCB by working out with RBI/DICGC that the DICGC will be repaid its dues by MSCB in a long term say of 20 years in 15 equal yearly installments, starting from 6th. Year. Govt. of Maharashtra could consider providing a BG on behalf of MSCB to DICGC for this.

- b) The terms of takeover could include an agreement with

- All the institutional depositors that their deposits would be repaid in 15 years , starting from 6th year .The rate of interest would be fixed say @6% p.a.

- All the individual depositors that their deposits would be repaid in 10 years, starting from 6th year. The rate of interest would be 6%.p.a.

The above figures are approximations and unconfirmed. Actual position has to be ascertained by Govt. of Maharashtra from RBI.

Delay of every day is costing the depositors dearly. The expenses of the PMC Bank, including salaries, overheads goes to further erode the deposits every month.

Govt. of Maharashtra will be doing a great favour to the urban cooperative banking sector in the Country which has over 50 per cent presence in Maharashtra state, if it could find a solution to the PMC Bank problem.

With Kind regards,

Yours Sincerely,

D. Krishna