Indian Cooperative received mails hinting at a multi crore scam in Balangir District Central Cooperative Bank in Balangir district in Odisha. We received these mails long ago but we are publishing them now to synchronize the whistle blower’s words with the bank hitting recently the media headlines for all the wrong reasons -Editor

Whistle blower account follows:

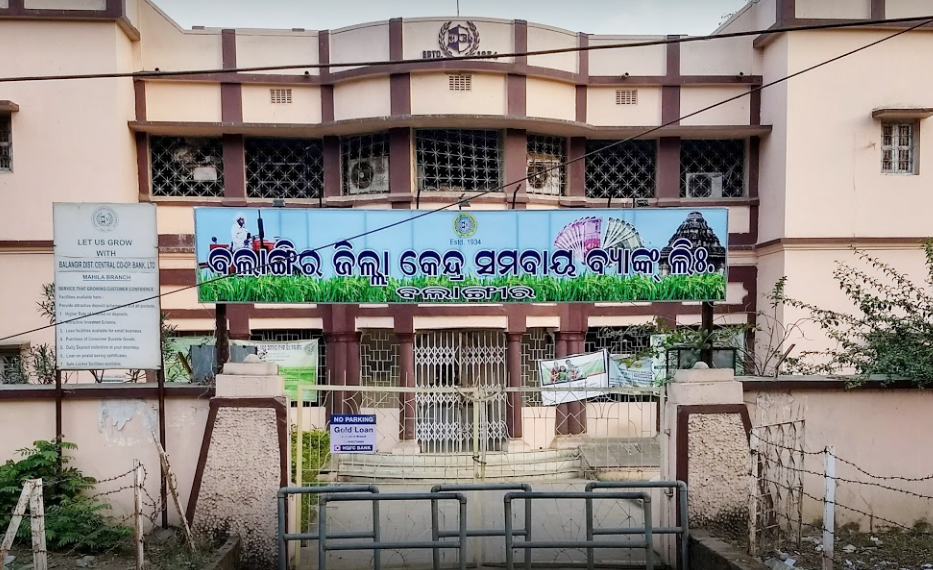

I would like to inform you about one of the most corrupt banks in Odisha-the Balangir District Central Cooperative Bank Ltd; Balangir, Odisha. Please save the bank. If properly inquired then the volume of corruption would be more than Rs50-60 crore.

The Balangir District Central Cooperative Bank Ltd; Balangir, Odisha; can also be called a most corrupt Bank because of the following grounds given below. If no stringent action will be taken jointly by the state government’s vigilance/ anticorruption/ cooperation department immediately the bank will collapse.

The position of the bank is very critical now due to mis-management of Mr Sudhir Kumar Chand(previous in-charge bank secretary), Mr Laxman Kumar Meher (President Managing committee of the bank), Sushil Chand Mr H C Das-bank secretary and employees’ union senior members (like Mr Sudhir Kumar Chand, Mr JK Mohanty, Mr Sudhir Nanda, Mr SB Satpathy, Mrs Jayashree Nepak, Mr SB Khamari,Mr Ganga Swain, Mrs K Nanda, J Padhan etc) and they have been acting like a goonda gang and emptying the public money from the bank continuously in broad day light and most of them have been working in the same station for more than 25-30 years through 21 branches of the bank in the undivided Balangir district. Most bank secretaries are behaving like puppets in the hands of management especially of Mr Laxman Kumar Meher- a local congress goonda presently working as President Management committee of the bank, Mr Sudhir Kumar Chand or Mr J K Mohanty.

Illegal medical reimbursements when Mr Sudhir Kumar Chand was the in charge secretary of the bank:

1. This is the bank for silly reasons you can be suspended but for major misconduct or fraud you are not. Here for illegally amassing the money at the cost of the bank you can be rewarded. In the Patnagarh branch as a BM Mr Sudhir Kumar Chand had illegally collected money from loanees (the persons who have taken loans from the bank). Thus at the cost of the bank he enriched and so he was awarded as I/C bank secretary. In July, 2015 Mr Chand had sanctioned Rs 1.7 lakhs to Mr S B Satpathy the head clerk of the bank for his (Mr Satpathy’s) wife’s medical treatment who is a regular teacher in the state government school. As per the rule, the medical expanses can only be disbursed for treatment of dependents but his wife is not a dependent of Mr Satpathy because she is a government servant. Mr Sudhir Chand has also taken Rs7 Lakhs illegally himself showing false bills for his heart treatment violating Odisha government’s revised reimbursement of medical claim memo no. DC & MA (MA)-45/2014-6246/H dated 04-03-2014 which is more than 15-20 times as prescribed in the circular. Besides that Mr Chand has also sanctioned medical claims to more than 15 employees of the bank (amounting to nearly Rs50 Lakhs) violating the pre-mentioned government circular which must be examined by the economic offences wing of the government and the money illegally sanctioned must be recovered from the employees and Mr Chand should be arrested immediately for this illegal act. Mr Chand has mis-used his power in an illegal way to enrich him and his followers. This is how public money has been eroded from the bank by Mr Sudhir Chand (then in charge Bank Secretary), Mr S B Satpathy (the head clerk of the cooperative bank), Mr Gangadhar Swain and some other employees and union leaders of the bank. This is one instance and there may be several instances like that and all bills and vouchers signed by Mr Sudhir Kumar Chand as I/C Bank Secretary, Mr S B Satpathy as Head Clerk, Mrs J Padhan as Clerk(legal section) should be thoroughly examined. These employees are behaving like a goonda gang and when situation warrants they attack unified and those who go against them they are transferred instantly and their promotions/ increments stopped for no cause. Mrs Kalyani Nanda has been taking bribes for loans in the main branch for more than 10 years.

Destruction of some important files:

2. This is the only bank in the world where by illegal gratifications to the Managers the loan files can be deliberately destroyed. For example, the mushroom cultivation files have been deliberately destroyed by the present Mahila Branch Manager, Balangir, Mrs Nirupama Sahu and poultry loan files has been destroyed from the present Sonepur main branch and many files from the other branches by illegal gratifications from loanees. Many loans are given improperly without keeping loan securities and guarantors (This is found mostly in Balangir Sadar, Main, Sonepur, Titlagarh, Birmaharajpur and Kantabanji branches of the cooperative bank). So the persons responsible for these misappropriations should immediately be dismissed from service and jailed in the interest of the bank. Some loanees like Mrs Manasi Sahoo, (advocates of Balangir bar) and many more persons have never been contacted because they may go against the bank in the court of law. As in maximum cases the employees were guarantors so the loan amount should be adjusted from their salaries/ pensions, etc. No Bank Secretary has taken any steps towards it because bank secretaries were deputed from the OSCB Ltd so they are not interested in loans collection. They are interested to extract as much money as possible from the Cooperative Bank during their tenure as bank secretary.

No Action on audit reports:

3. This is the only bank in the world where no action is taken by the government’s cooperation department if the irregularities whatsoever are found and it has been detected, mentioned and reflected in yearly audits which can be verified easily from cooperative audit office in Balangir. The defects shown are neither strictly followed nor any action taken against the erring officials. This year more than Rs64Lakhs irregularities is shown but no action has been taken by the bank secretary.

Frauds and misappropriations:

4. In this bank qualified employees never get promotion and increments but to be eligible for getting promotions and other service benefits one should be involved in some scams (like RI-Amin Scam-Mr Sadangi-the driver & Mr RC Dixit-the previous bank secretary- promoted to AGM rank by OSCB), frauds (Mr C D Pradhan, Mr Gangadhar Swain), misappropriations or some other major misconducts/ irregularities. If a vigilance case (like Mr Sudhir Kumar Chand, Mr C D Pradhan and Mr GangadharSwain) or criminal case is there, there is every possibility that you can be given a single or double promotion in a day depending upon the severity of the case.

Here you will find many crorepatis as compared to other banks because these peoples have amassed money in an illegal manner at the cost of the bank.

Instead of loan collection and depositing that in the bank they take bribes and loans are not truly collected. Many vehicles which are brought from defaulters are not auctioned. This is the position in most branches. For that reason Mr Chakradhar Pradhan and Mr Gangadhar Swain are multicrorepati, whose residence & office was recently raided by vigilance department. Surprisingly they have not been suspended and have been working as AGM and Manager in the bank till today and all staffs are working under them. This is giving a wrong signal to sincere employees of the bank because instead of being removed from service they have been given more responsibilities and powers. Some other multicrorepatis are Mr Sudhir Kumar Chand (Previous in-charge Secretary), Mr Sashi Bhusan Satpathy, Mrs Jayashree Nepak, Mr A K Sarangi (Driver), Mr J K Mohanty, Mr Sudhir Nanda (Sadar branch), Mrs Nirupama Sahu (Manager-Mahila Branch), Mrs Kalyani Nanda, Mr R C Dixit (previous secretary of the bank) to name a few. These persons have become crorepatis by working in this bank and did not inherit any property from their ancestors though their salaries are quite low as compared to other public sector or private banks.

Illegal Double promotions in a day to some staffs:

5.Four employees have got double promotions in the same day on 03 January, 2009 including Mr Jayanta Ku Mohanty violating Staff Services Rules, 1984 by Mr P K Mohanty, the then bank secretary. On 02-01-2009 Mr Jayanta K Mohanty was working as an Asstt Supervisor but on 04-01-2009 he became Branch Manager of the main branch of the bank without working a single day as an Administrative Inspector. Also in this promotion, Mr Chakradhar Pradhan, Mr Sudhir Kumar Chand and Mr Bairiganjan Mishra were also promoted to the rank of Manager (presently AGM). In the Bank’s Staff Service Rules, 1984, at page 5 under section 7(3), it is clearly mentioned that a Manager should have done HDC training / Labour law & personal management / Vaikunth Nath Mehta National Institute of Cooperative Management or RBI training or course. In this promotion depending upon the money one could able to give as a bribe to Mr P K Mohanty, then bank secretary the employees were promoted violating the staff services rules, 1984 which was prevalent at that time. So the promotion given in January 2009 should be reverted as soon as possible.

Violations of NABARD/ RBI circulars and guidelines:

6.Here many times letter no 4906 dated 08/09/2014 of the AGCS-Bhubaneswar is violated by the Managing committee because under the DONOT category it is clearly stated that the management should not involve in matters relating to personnel administration of the staffs but they are always involved. Every transfer and posting is done by them and the bank secretary only signs the document.

What is needed immediately to save the bank from imminent downfall?

1) Economic offences wing or vigilance or the government cooperation department should immediately investigate these and other similar matters and take necessary action in the interest of the stakeholders of the bank.

2) All financial transactions made by the in-charge bank secretary Mr Sudhir K Chand, Mr S B Satpathy (HC and Manager) & Mr C D Pradhan (AGM) and Mrs Jyotshnamayee Pradhan (legal) should be scanned properly. Special audit should be done.

3) Corrupt officials found should be dismissed immediately.

My name should never be disclosed. This is my sincere request. As a well-wisher of the bank I have written these so that you can verify, investigate (I have given phone nos too) and examine it. This is written in the interest of the common men, farmers, vendors and daily laborers of Balangir & Sonepur districts.

This Grievance is Registered with CMGC-odisha vide Registration no. CMOFF/E/2015/01736 On 05-11-2015 but till now absolutely no action has been taken. So I request your kind intervention in the matter.

Yours sincerely

(Name withheld to protect whistle blower’s identity)

Meanwhile, the daily The Pioneer reports:

Affairs in the Balangir District Central Cooperative Bank (DCCB) Ltd do not seem to be going usual way as its president Laxman Kumar Meher is continuing in office after being reinstated in an alleged “malafide” manner for more than a year now.

“After an inquiry into the allegations of misconduct, the Deputy Registrar of Cooperative Society (DRCS) sacked Meher from the president post in June 2016. However, Meher challenged his ouster at the Orissa High Court. While the HC directed the Registrar Cooperative Society (RCS) to conduct an inquiry and take action in two months, the later didn’t conduct any inquiry. Meher then filed a contempt of court case against the RCS. Later, the RCS appeared in person in the court, filed an affidavit and reinstated him on December 22, 2016. But on a later date, the RCS filed a writ petition at a division bench of the High Court providing support to the DRCS’s decision of ouster of Meher,” complainant Sananda Kuamr Meher, a Director of the DCCB, told The Pioneer.

The RCS, Dr Shashi Bhushan Padhi, has now retired.

Terming president Meher’s continuance as ‘illegal’, the Director demanded Meher be kept away from the post till the inquiry is completed, which is again going on by the DRCS, on the direction of the Government.

“The DRCS ousted him finding truth in allegations of illegal appointment, promotion and finance transactions made by him. The RCS appointed him a tricky way and filed a writ petition for lingering the case as the five-year term of Meher, who was appointed in 2015, will expire in 2020,” the Director alleged and demanded that he be kept away from the post in the better interest of the bank, its depositors and farmers till the inquiry is completed.