The Andhra Pradesh based Maharaja Cooperative Urban Bank, with a business mix of approximately Rs 450 crore, is in the early stages of merging itself with Telangana’s Adarsh Cooperative Urban Bank, which is headed by NAFCUB Director Madana Gopala Swamy.

Although Maharaja Cooperative Urban Bank meets the criteria of being financially sound and well-managed (FSMW), it faces challenges in adapting to the rapidly changing banking environment, such as adopting new technologies. Furthermore, the bank has found it difficult to operate smoothly due to what it perceives as a lack of support to UCBs from the RBI.

The proposed merger is in the preliminary stages. A resolution was passed by the bank’s members during the recent Annual General Meeting, but the process may take time to complete.

The bank aspires to transform into a Small Finance Bank (SFB). However, achieving the necessary parameters for this transition independently could be a time taking and difficult process.

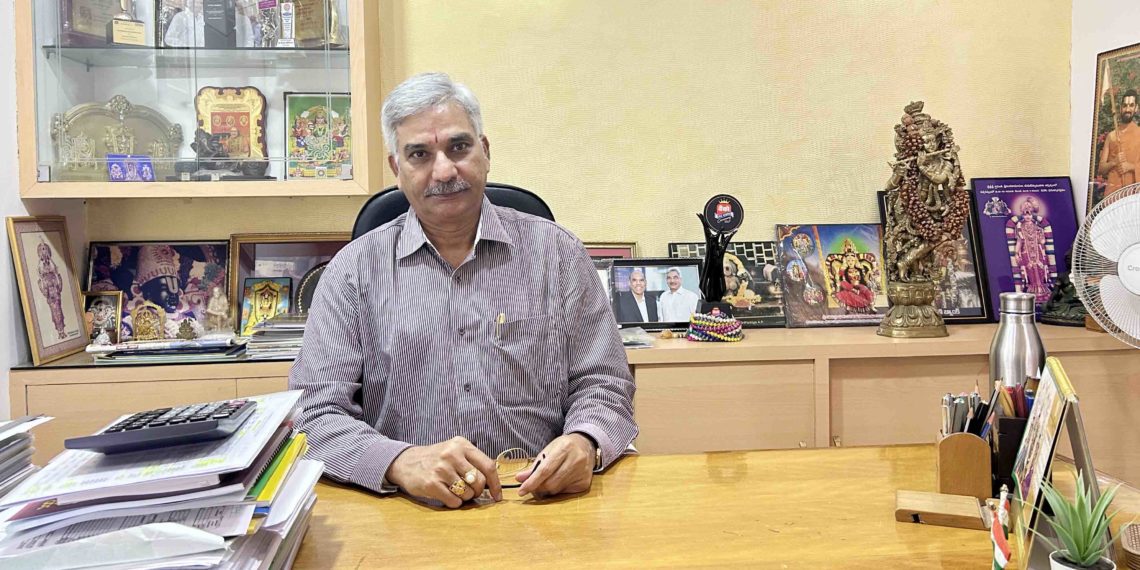

The bank’s Chairman Rama Krishnam Raju shared these details during a visit of this correspondent to the bank’s headquarters in Visakhapatnam. Raju, the bank’s founder Chairman, is credited with steering the bank to new heights.

“The urban cooperative banking sector faces numerous obstacles, making the survival of smaller banks like ours uncertain. We struggle with small-ticket loans and meeting priority sector targets,” Raju stated.

He also highlighted the challenge of complying with the RBI mandates, “With branches in urban and semi-urban areas, it’s difficult to meet RBI’s targets for loans to weaker sections. Identifying borrowers in this category is tough. We urge the RBI to consider raising the loan amount under this category from Rs 1 lakh to Rs 2.5 lakh.,” he urged.

Raju elaborated on the bank’s decision to merge with Adarsh Cooperative Urban Bank, explaining, “The evolving banking environment requires the adoption of new technologies, but we lack the substantial funds needed for these upgrades. Additionally, our current net worth disqualifies us from voluntary conversion to an SFB under RBI norms. This is why we are exploring a merger with one of Telangana’s largest UCBs.”

On the financial front, Raju shared, “As of 31st March 2024, our deposits stood at Rs 265.96 crore and advances at Rs 177.33 crore, with a net profit of Rs 3 crore. Our net worth is Rs 27.76 crore, and the net NPA stands at 0.81 percent. The bank declared a 14 percent dividend for shareholders,” he said.

Maharaja Cooperative Urban Bank currently operates nine branches in Visakhapatnam and Kakinada, with plans to open a new branch in Anakapalli this November. “Earlier, our operations were limited to a few districts in Andhra Pradesh, but we have now received permission to expand across the entire state. We are making steady growth instead of achieving growth fastly” he added.

Established on 5th May 2000, the bank is set to celebrate its 25th anniversary next year.