Maharashtra based Multi-State Scheduled Bank- NKGSB has done a spectacular work particularly in controlling the Gross NPA and the Net NPA during the 2018-19 financial year. The figures were revealed during the 102nd Annual General Meeting of the Bank held last week in Mumbai.

The bank’s Gross NPA decreased from 5.97% to 3.82% whereas as Net NPA stood at 1.72%. The latter was 3.66 percent. The bank plans to achieve a business mix of Rs 16,000 crore by the end of March 2020.

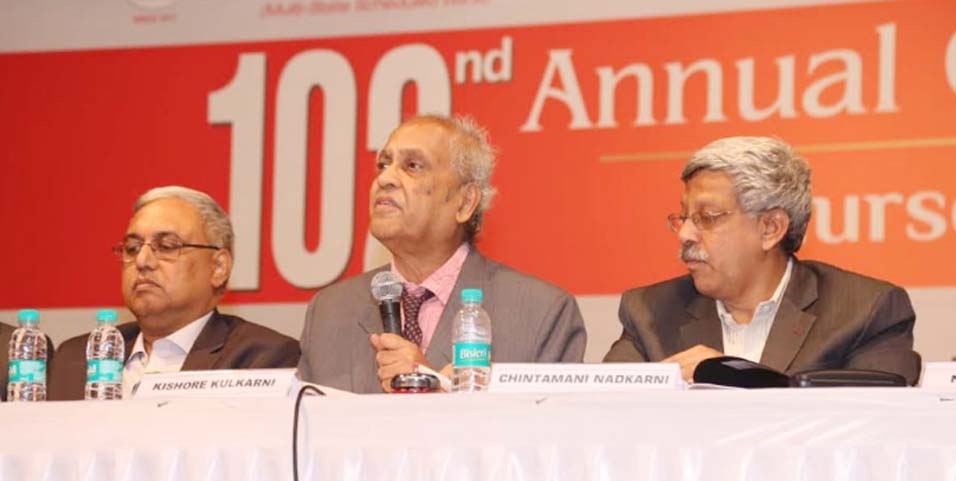

Sounding euphoric, Chintamani Nadkarni, Managing Director of NKGSB Bank informed, “Financial year 2018-19 was satisfactory especially on account of controlling the NPA of the bank. Our management played a very important role in slowing down the NPA and recovery was very high during the FY. Besides, advances witnessed a marginal fall by 1 percent because we had not lent too much credit and focused on controlling the NPAs account”, asserted Nadkarni on the phone.

“The bank has set its sight to achieve Rs 25,000 crore business in the next three years and as a first step has targeted for 16000 crore by the end of March, 2020. The bank business mix stood at Rs 12,852 crore as on 31st March 2019 registered a growth of 5 percent. The bank’s CD ratio stood at 69% compared to 76% last year”, he informed.

The deposits of the Bank grew by 9% and reached Rs 7,601 crore as on March 31, 2019, as against Rs 6,945 crore in the previous year. Owned funds stood at Rs 776 crore.

During the financial year, the bank earned a net profit to the tune of Rs 40.26 crore. The bank has announced 10 percent dividend for its Shareholders.

During the year, the bank has set up two new branches, one at Waluj in Aurangabad and another at Maninagar in Ahmedabad. Currently, the bank has a network of 109 branches spread across five states of Maharashtra, Goa, Karnataka, Gujarat and Madhya Pradesh.

As a part of increasing ancillary business, the bank has Corporate Tie up for Insurance besides undertaking Mutual Fund Business. For Mutual Fund business, the bank has tied up with SBI Funds Management Co. Ltd. in addition to their existing tie-up with other mutual funds.

During 2018- 19, the bank had a tie up with Yes Bank for issuance of Travel Cards in 10 currencies to clients visiting various tourist destinations. The bank Chairman Kishore Kulkarni, Vice-Chairman Sunil Gaitonde, board members, more than 200 delegates and others were present on the occasion.